This Week Market Drivers

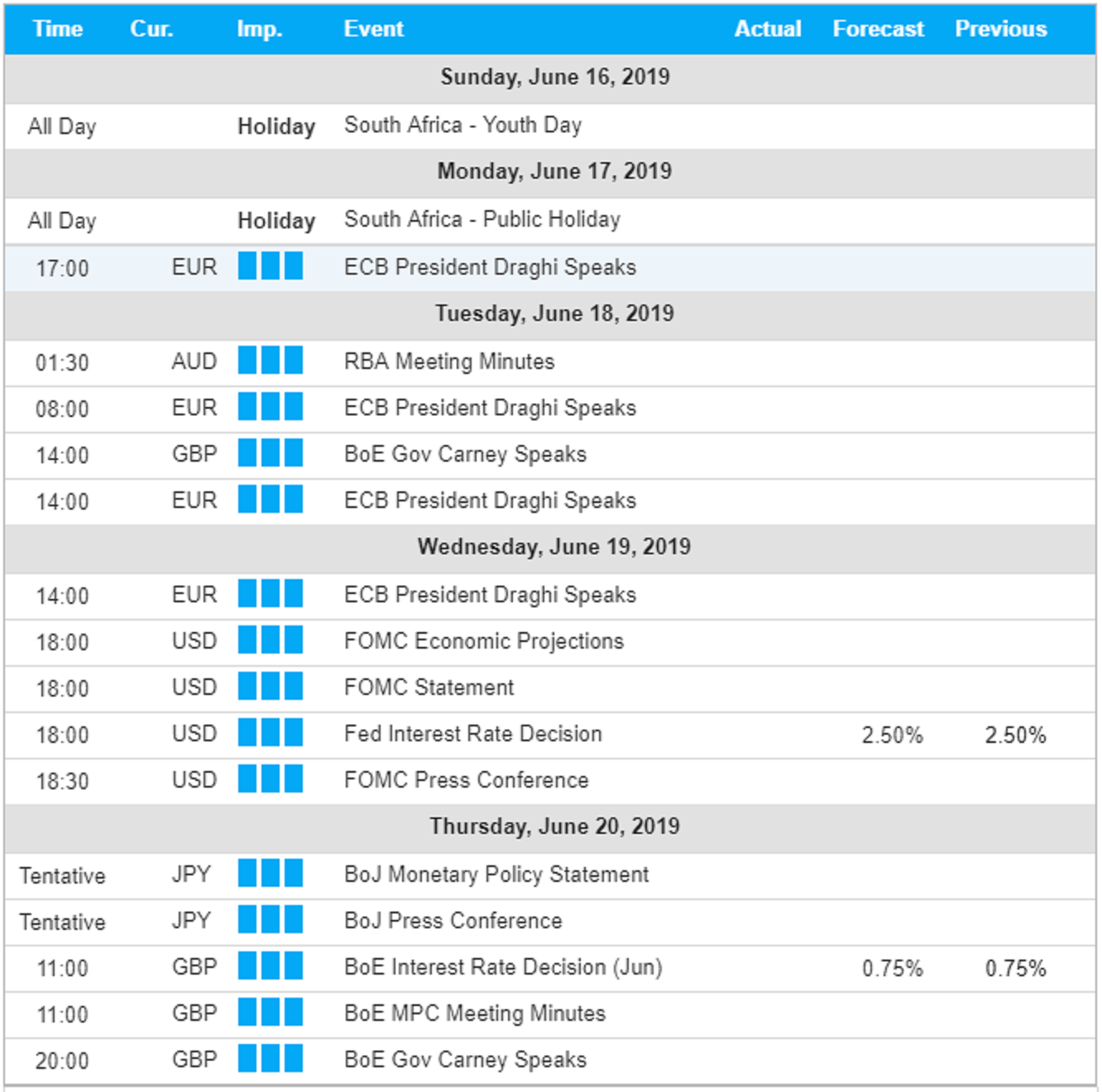

- ECB President Mario Draghi Speaks 3 times this week; today 18:00 GMT+1, tomorrow at 9am and Wednesday at 15:00 European Central Bank (ECB) President Mario Draghi Speaks; he has more influence over the EUR value than any other person. His comments may determine a short-term positive or negative trend; wide price swings across Euro assets predicted during this week speeches;

- Tomorrow 2:30 GMT+1 Reserve Bank of Australia (RBA) Monetary Policy Meeting Minutes due; a more dovish than expected minutes could be taken as negative/bearish for the AUD, while more hawkish than expected minutes could be taken as positive/bullish for the AUD;

- Wednesday 19:00 GMT +1 U.S. Federal Reserve's Federal Open Market Committee (FOMC) Interest Rate Decision and FOMC statement; a more dovish than expected statement could be taken as negative/bearish for the USD, while a more hawkish than expected statement could be taken as positive/bullish for the USD; interest rates are forecasted to remain unchanged at 2.5%; however speculation is that the US FED may be leaning towards a policy of lower interest rates with most analyst forecasting that the US Fed will make a move to lower interest rates in September; this weeks FOMC statement will be viewed as providing clues ahead of Septembers interest rate decision; high price action across USD assets is forecasted upon the release of this week US FOMC Economic projections;

- Thursday Bank of Japan (BoJ) Monetary Policy Statement; contains the outcome of the BoJ’s decision on asset purchases and commentary about the economic conditions that influenced their decision;

- Thursday 12:00 GMT+1 Bank of England (BOE) Interest Rate Decision forecasted to remain unchanged at 0.75%; traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation; a higher than expected rate is positive/bullish for the GBP, while a lower than expected rate is negative/bearish for the GBP;