Crypto Asset Commentary

Bitcoin and Gold Alternative Asset Classes

Bitcoin is an alternative asset class and is around 10 years old.

The Greeks introduced gold coins in 560 BC.

Gold as a currency grew fast and helped trade grow around the Mediterranean and the Middle East.

The idea of a digital currency is not new. The ability to transfer goods or services not linked to a central government has long existed…

Think of a common barter trade system, where transactions take place directly by exchanging goods or services…

I have 10 goats and you have a cow…let’s make a trade!

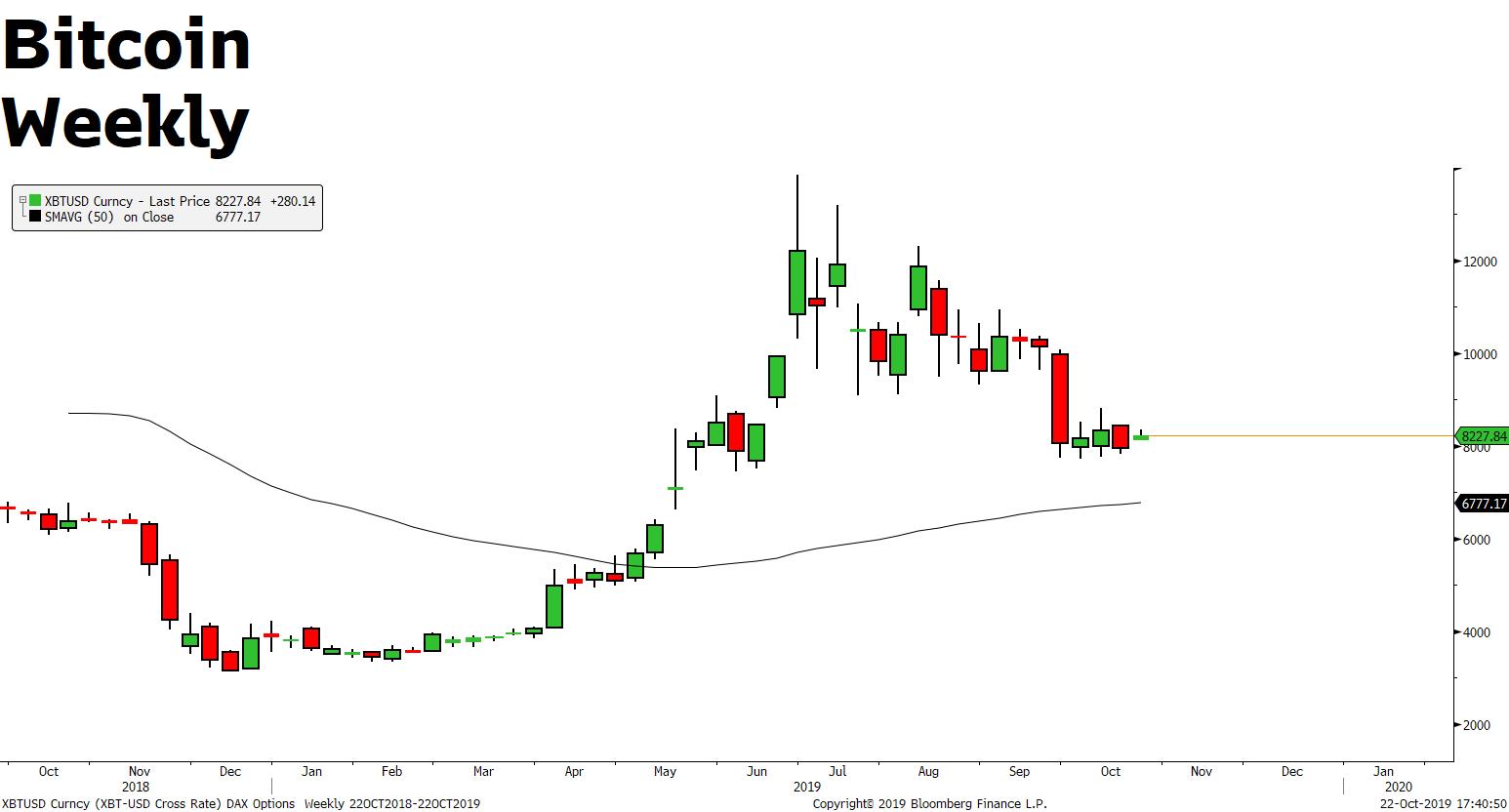

Will Bitcoin Become Digital Gold?

Bitcoin’s evolution as an alternative asset class is advancing as more large institutions offer support for this new alternative asset class.

Why the demand for Crypto’s like Bitcoin?

The Eurozone has negative interest rates and many countries around the world have very high debt levels.

Investors who normally lend money to countries have recently shown signs that they are worried about a country’s ability to pay back a loan. Remember Greece had to be bailed out from going bankrupt…other countries such as Italy and Spain also have very high levels of debt and investors fear that if these countries lose the ability to borrow more money from the international markets to pay back current lenders that they will not get their money back.

But Countries Can Create New Money as “Cash”?

When a country or group of countries such as the EU print or create money, this money is backed up against good faith that the issuing country will honour the amount printed on the cash note.….But what if investors lost faith in a county or a block of nations such as the European Union?

As more countries head down the road of negative interest rates and if the burden of high levels of debt remain, demand for alternative assets should continue to grow.

Bitcoin and other Crypto assets are very new alternative assets. These new assets will remain very volatile until the emergence of digital assets becomes more widely accepted.

Bitcoin a 24/7 Market

Until that happens and as the investment world attempts to balance the demand and supply factors for Cryptos, individual investors and speculators can access and trade the volatile price swings of Crypto assets in the form of a CFD product 24/7 via our trading platform.

Bitcoin is one of the only assets that trades during weekends and the price tends to spike on weekends. In fact, according to Bloomberg Bitcoin price surges during weekend trading since the beginning of May 2019 account for about 40% of Bitcoin’s price gains this year.

Source: FXGM Investment Research Department