Traders on high alert ahead of tomorrow's big economic events:

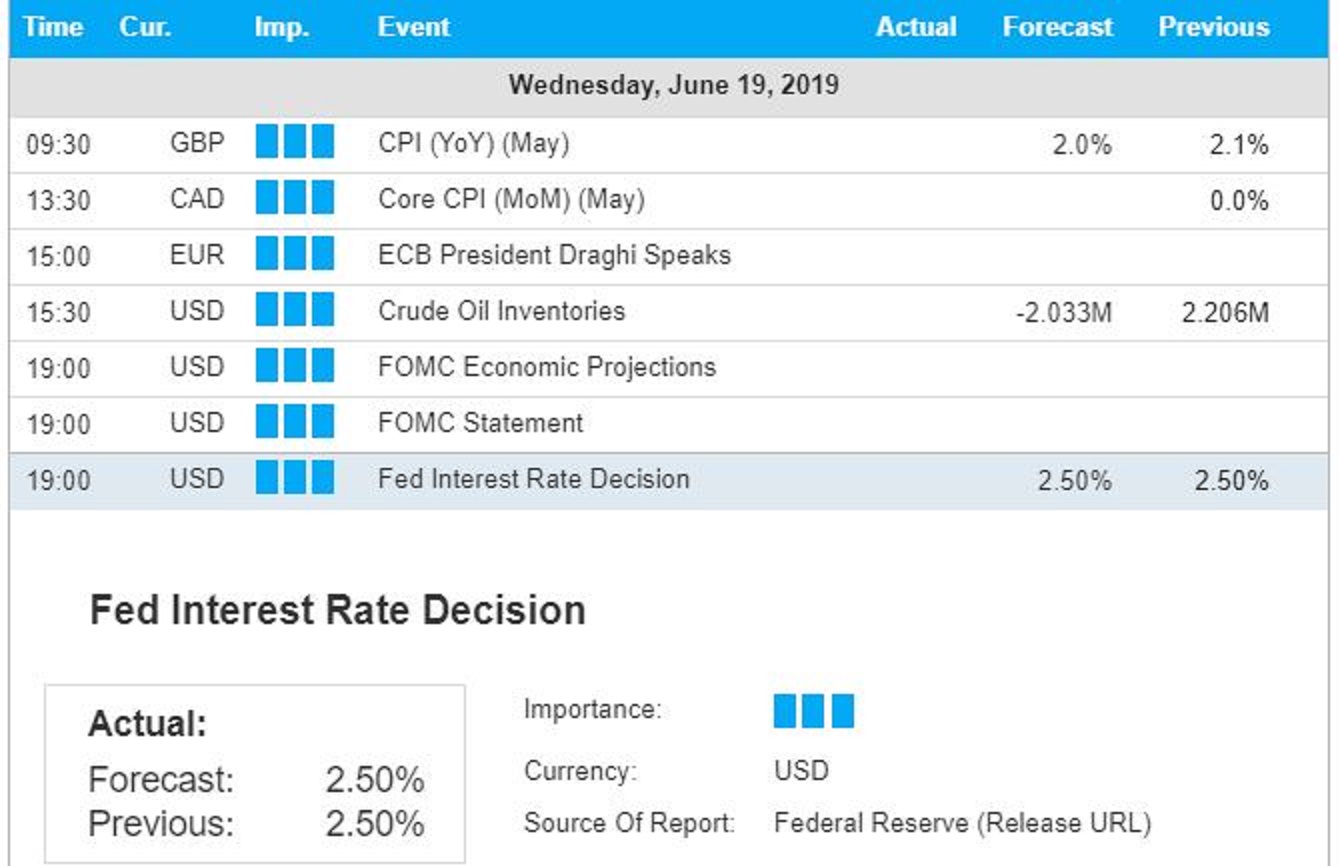

Upcoming events for Wednesday, June 19, 2019

- 15:00 GMT+1 - European Central Bank (ECB) President Speaks

- 19:00 GMT+1 - US Federal Reserve Interest Rate Decision; forecast to remain unchanged at 2.5% ; however high price action across USD assets is predicted as traders will be on high alert for clues of a potential September rate cut

Market Drivers

- European Central Bank (ECB) adds fuel to stock markets saying that lower interest rates remains a "tool" if needed to add more stimulus to keep EU economies moving ahead;

- US, EU and Australian signalling a shift to lower interest rates; Precious Metals moving higher; Gold +$19 last 5 days, Silver attempting to start new up-trend; EUR and AUD under pressure ; US Dollar holding within multi-month uptrend;

- Technical Alert: Eurostoxx 50 Index breaks above resistance after European Central Bank (ECB) adds fuel to European stock markets saying the ECB willing to use its “tools” to stimulate the European economies; current price 3435; upside 3519 to 3633, support 3260

- German DAX Technical Alert; price breaks above 12,212 resistance further upside remains provided price can call 12,212 new support level; current price 12,267; upside 12,485 to 12,795 provided price hold above 12,212; support 11,920; Today’s ECB president speech helped as a break-out catalyst,

- SP500 +23.25 points last 5 days on expectations that the US Federal reserve move make a move to lower US interest rates to support a slowing US economy; current price 2910.25; resistance 2932.75; support 2812.75; a break above 2932.75 opens up potential price extension towards 3019 and 3103;

Charts

SP500 Index upside momentum intact after breaking above the multi-month downward trendline (Bullish); RSI analysis is bullish since it crossed above its signal line; moving average analysis is bullish as current price is trading above the 4,9, and 18 period moving averages; current price 2,909.25; resistance at 2,932.75 needs to be overcome in order to open up a price extension towards the 3,019 to 3,109 zone; otherwise a failure for price to create a new support above 2,932.75 leaves open the potential for a re-test of the 2,812.75 support. Traders should be alert for price breakouts.