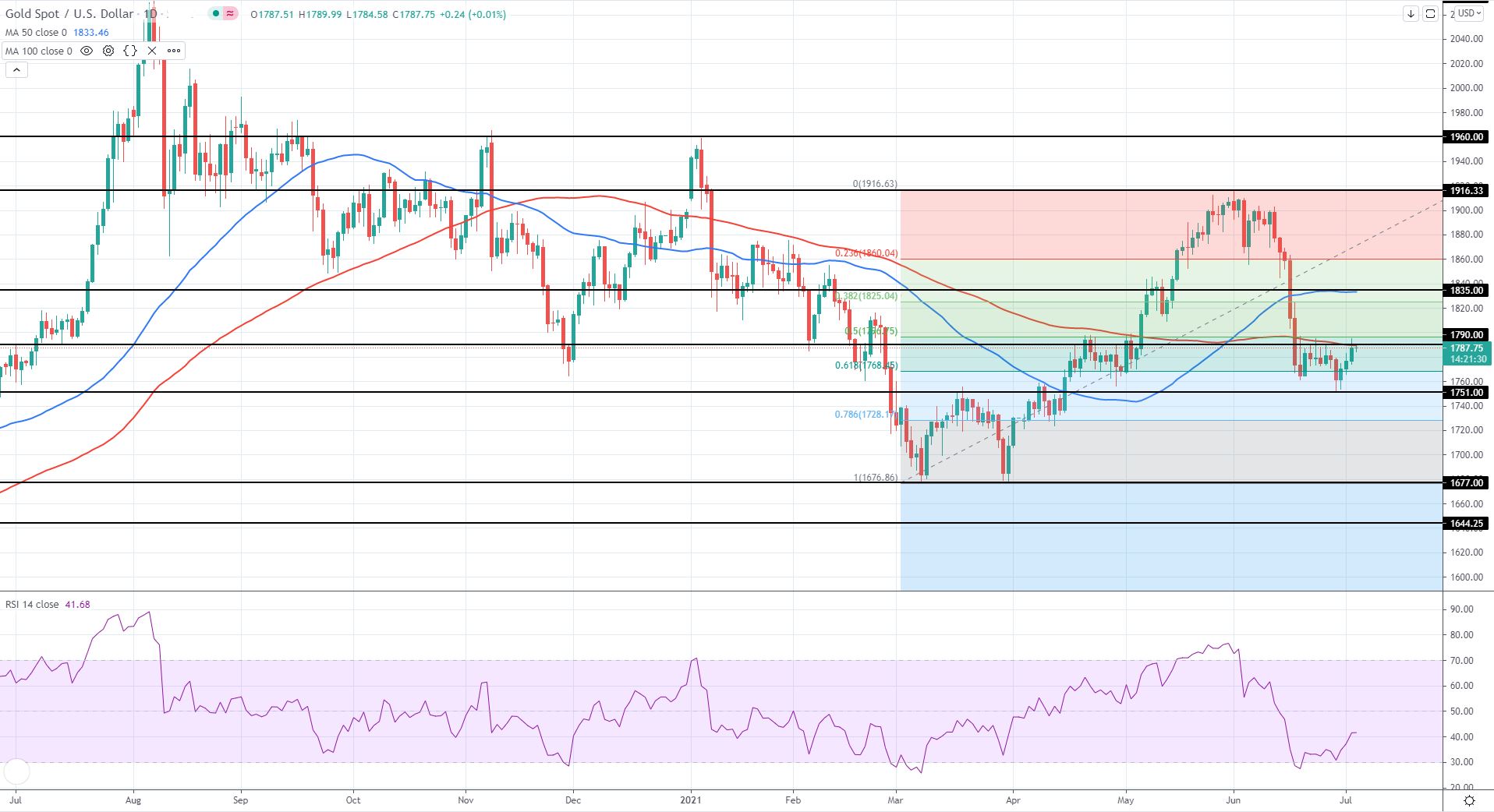

For the bulls, important resistance levels exist at 1790.00 area where the MA100 stands now, also at 1835.00 derived from the MA50 level at this moment, and finally at 1916.00 level derived from the June 1st top.

For the bears, support levels exist at 1751.00 level derived from the June 29th bottom, also at 1676.00 where the 8th of March double bottom resides, and finally at 1642.00 derived from the March 26th 2020 inside support top.

A really busy day with PMI data coming from the EU Area and the Eurozone, which will be in focus today. PMI Stats expected from Spain, Germany, Italy, France, UK and the EU. Consumer Confidence is also expected to play a role.

• Major stock indexes in Europe finished the last trading session of the week mixed. The FTSE 100 and the CAC 40 were virtually flat at the closing bell. The DAX increased 0.30%, and the EUROSTOXX50 was up 0.13%.

• Cancelling the sovereign debt generated by the governments in the euro area makes no economic sense, European Central Bank President Christine Lagarde (pictured left) stated on Friday, adding that the solution would be "like borrowing from Peter to pay Paul."

To scrap the debt would be in opposition "to the legislation" and would constitute "an infringement of the treaties," Lagarde pointed out. "It makes no economic sense, because interest rates are extremely low at the moment and because if a country were to stop repaying its debts, lenders would be reluctant to fund it. That’s what happened to Venezuela, Argentina and Lebanon," she concluded.

• Euro zone producer prices accelerated in May, driven by a surge in energy prices, data from the European Union's statistics office Eurostat showed on Friday.

Eurostat said prices at factory gates in the 19 countries sharing the euro rose 1.3% month-on-month for a 9.6% year-on-year increase.

• Spain Unemployment registered in the offices of the State Public Employment Service (SEPE) fell by 166,911 people in June compared to the previous month, the largest drop in any month since there is a record. In relative terms, it represents a drop of -4.41%. In the last four months, registered unemployment has decreased by 394,450 people.

• Britain's factories extended their post-lockdown recovery in June and ramped up hiring, but they also faced record inflation pressures due to supply chain problems caused by the coronavirus pandemic, a survey showed on Thursday.

The IHS Markit/CIPS UK Manufacturing Purchasing Managers' Index (PMI) dipped to 63.9 from an all-time high of 65.6 in May. It was also down a touch from a preliminary "flash" reading for June of 64.2.

Important Daily Events:

• At 07:15 (GMT) Spanish Services Purchasing Managers Index (PMI) is due. This indicator is a survey of about 350 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

• At 07:45 (GMT) Italian Services Purchasing Managers Index (PMI) is also due. This is a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

• At 07:50 (GMT) French Final Services Purchasing Managers Index (PMI) is expected . The PPI measures the Change in the price of finished goods and services sold by producers. This is a report released monthly, on the third business day after the month ends.

• At 07:55 (GMT) German Final Services Purchasing Managers Index (PMI) is also expected. This indicator measures the level of a diffusion index based on surveyed purchasing managers in the services industry.

• At 08:00 (GMT) EU Final Services Purchasing Managers Index (PMI) to be announced. A number above 50.0 indicates industry expansion, below 50.0 indicates contraction.

• At 08:30 (GMT) UK Final Services Purchasing Managers Index (PMI) coming up. A number where Actual' is greater than 'Forecast' is good for the currency.

• At 08:30 (GMT) EU Sentix Investor Confidence results are due. This is a survey of about 2,800 investors and analysts which asks respondents to rate the relative 6-month economic outlook for the Eurozone.

European indices Friday :

• DAX: +0.30%

• EUROSTOXX 50: +0.13%

• FTSEMIB: -0.01%

• CAC40: -0.02%

Sources: Investing.com, forexfactory.com, breakingthenews.net