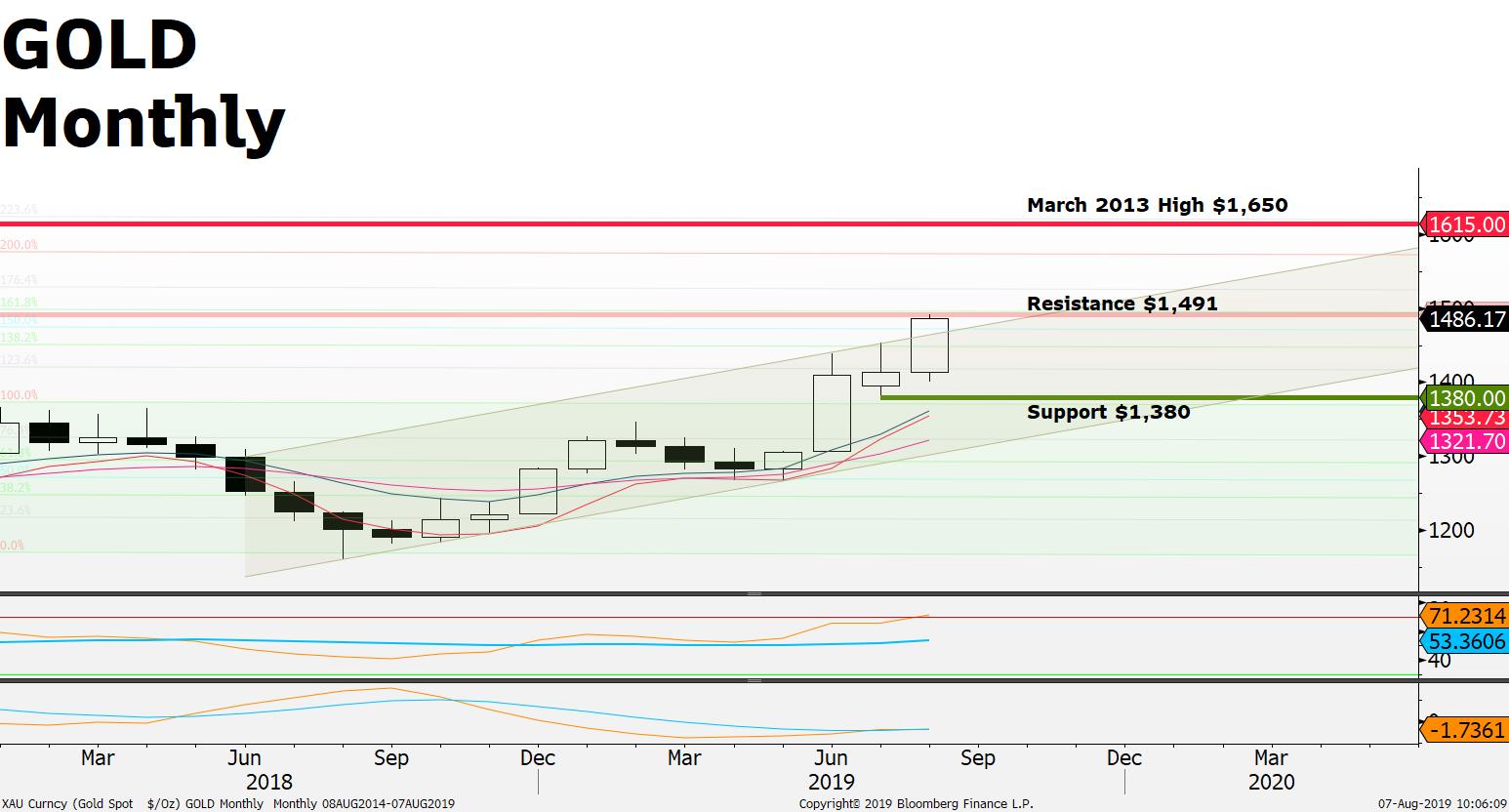

Demand for safe haven assets; US - China trade war carries on; global growth slows and global central banks rush to cut interest rates all helping to support gold demand; Current price; $1,487; resistance at $1,491 a break above may open up a test of the March 2013 high at $1,650; support seen at $1,380;

Events to Know for Today:

- Disney missed earnings and sales; share price falls -4.1% in after market trading; new Star Wars theme park cost hits earnings;

- The Reserve Bank of New Zealand (RBNZ) cuts interest rate to 1% from 1.5%; NZD/USD falls -2%; AUD/USD follows with a -65 pip drop as New Zealand gets aggressive with interest rate cuts to stimulate its economy;

- India cuts its base interest rate from 5.75% to 5.4%; India’s Nifty 50 stock index moved higher on the rate cut;

- US Crude Oil Inventories due today; forecast to fall by -2.845 million barrels; Crude Oil breaks below the $53.70 support; downside momentum remains; potential next leg lower near $50.95 support; Crude Oil (CL) down -21% since April; fears of reduced demand for Oil on the back of the ongoing US – China trade war adding to downside pressure;

Source: FXGM / Bloomberg