March 05 Market Review

- In the Economic Calendar of today, we can expect some volatility in the USD, GBP and CAD

- At 13:30 (GMT) the US Department of Labor will announce Initial Jobless Claims for the week, and the number is expected to be reduced to 215,000 from 219,000 of the previous week – If it decreases it could strengthen the USD against its pairs

- At 17:00 and 17:45 (GMT) the Governors of the Bank of England and Canada will give their speeches which could create volatility in the GBP and CAD

- The European Central Bank and the Bank of England are expected to announce stimulus measures in the coming days, after the Federal Reserve surprised global markets with a large rate cut

On the Charts:

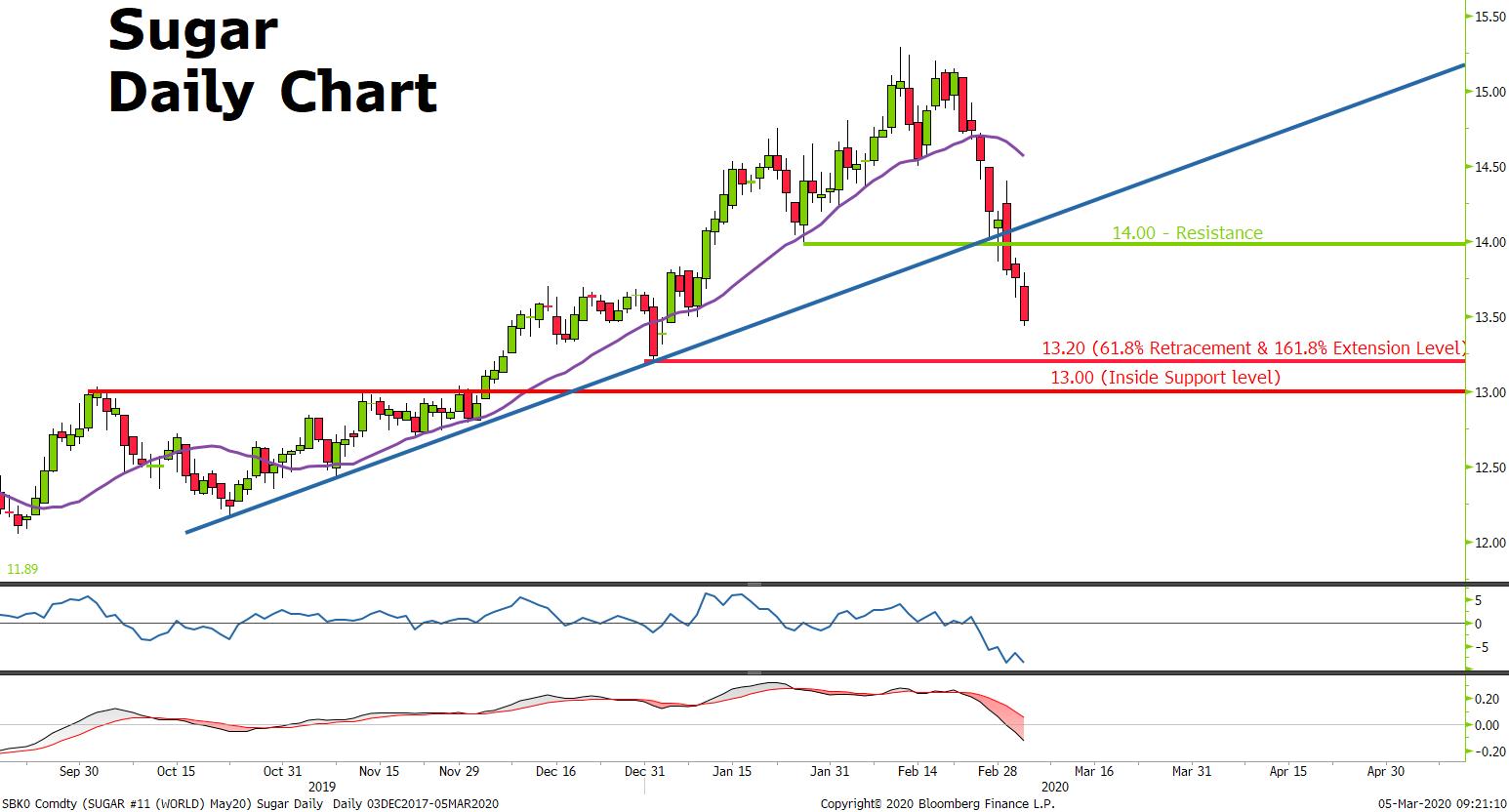

- The price of Sugar has broken the blue upward trendline to the downside

- Sugar Price is now 13.47, below the 20 Days Moving Average

- Momentum Indicators (Rate of change 6 periods and MACD) are both below 0, showing a bearish attitude therefore we may see the price moving lower:

- Target 1: 13.20 (61.8% Retracement level From 11.89 to 15.28 & 161.8% Extension Level From 14.00 to 15.28)

- Target 2: 13.00 (Inside support level)