- In the Economic calendar of today we can expect some volatility in EUR, USD, and CAD

- Spain, Germany, and Italy announced in the morning their Unemployment rates for the previous month

- An increase in the above result usually acts as negative for the EUR while a decrease acts as positive

- At 09:00 (GMT) the Statistics office of Europe will announce the Unemployment Rate for Europe

- The above it is a leading indicator for the European Economy and the result is forecasted to increase to 8.2% considering the last month that was at 7.4%

- At 12:15 (GMT) the Automatic Data Processing Inc will release the Employment change in US for the previous month

- The above is a measure of the change in the number of employed people in the US

- At 14:00 (GMT) the Bank of Canada will announce their Interest Rate Decision

- Usually an increase in the Interest rates acts as positive for the respective currency while a decrease acts as negative

- The result is forecasted to remain the same as the April’s decision, at 0.25%

On the Charts

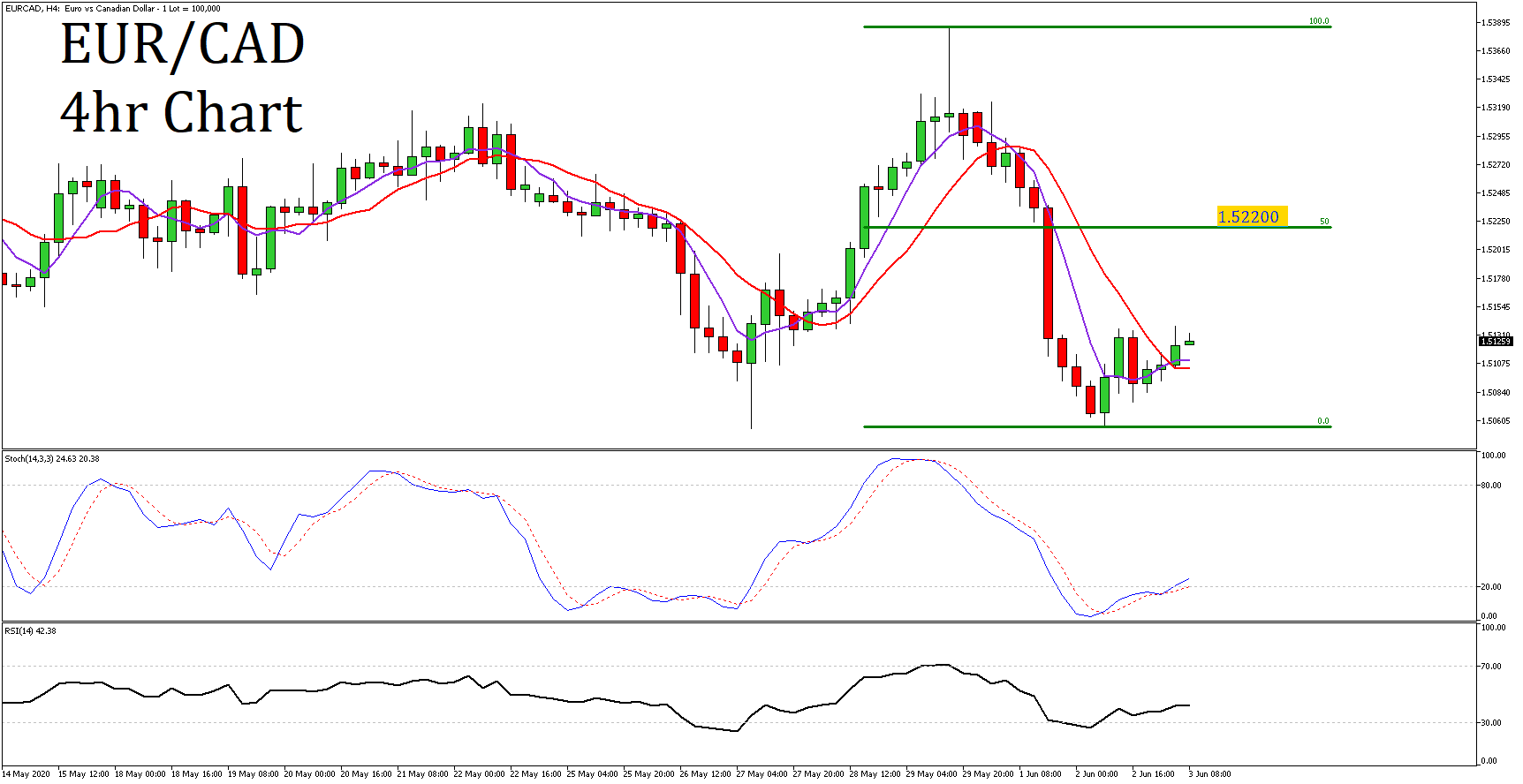

- As we can observe on the EUR/CAD 4hr chart, the price has found support at a previous support level and reacted to the upside

- The price is now at 1.51260, above the 5 (purple) and 10 (red) Moving Averages (MA)

- The 5 periods MA crossed to the upside the 10 periods

- RSI and Stochastic formed a failure swing bottom, and they are now above their extreme areas, indicating some over-extension in the previous downside movement

- Considering the above we may see the price moving higher and testing the 50% Fibonacci Retracement Level and an inside resistance at 1.52200