- In today’s Economic calendar we can expect some volatility in the EUR and USD

- The European Countries will announce in their Markit Manufacturing PMI

- That number measures the business conditions in the manufacturing sector

- At 8:00 (GMT), the National Institute of Statistics of Italy will announce their Unemployment Rate

- The result is forecasted to increase to 10%, considering that last month was 9.8%

- At 9:00 (GMT), the Eurostat will announce the Unemployment Rate of the European Economy

- The result is forecasted to remain the same as last month at 7.4%

- At 12:15 (GMT), the Automatic Data Processing of the USA will announce their Employment Change

- The result is forecasted to decreased to -154K considering that last month was 183K

- At 14:00 (GMT), the Institute for Supply Management of the USA will announce their ISM Manufacturing PMI

- That number shows business conditions in the US Manufacturing sector

- The result is forecasted to decrease to 45 considering that last month was at 50.1

On the charts

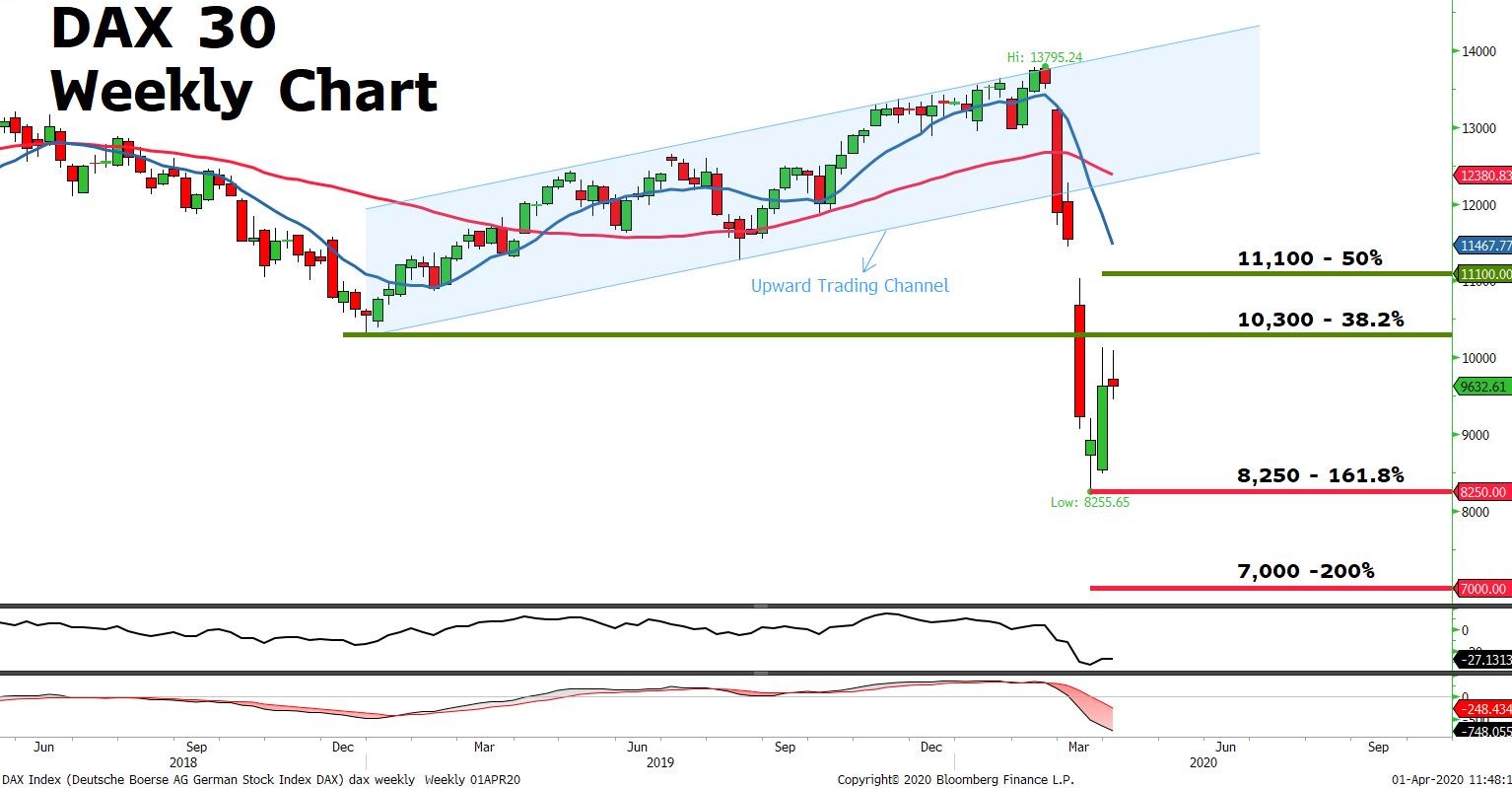

- The Germany’s DAX 30 price has broken to the downside from the upward trading channel that was in place from December of 2018 till the first week of March 2020

- The price in March had sharply fallen to 8,255, almost a 32% decrease

- That point consists the second target of our channel, a previous support and the 161.8% Fibonacci Extension level (From 10300 to 13795)

- As expected, the price reacted to the upside testing the 10,300 price level which consists the 38.2% Fibonacci retracement level (From 13795 to 8255) and a previous resistance

- The momentum remains bearish since both ROC (13 Periods) and MACD are below zero

- The 10 weeks Moving Average (blue) crossed to the downside the 40 weeks Moving Average (red)

- If the price does not break that level to the upside and this week closes below it, there is a possibility to see the price moving lower to retest the 8,250 level. A breakout below that level, may lead the price to 7,000, the 3rd target of our channel and the 200% Extension level of the previous move (From 10300 to 13795)

- Otherwise, we may see the price testing the 50% Fibonacci Retracement level, at 11,100