- In today’s Economic Calendar we can expect some volatility in the USD

- At 12:30 (GMT), the Department of Labor Statistics of the USA will release their Consumer Price Index (CPI)

- Those figures measure the average basket price of consumer goods and services

- The result is forecasted to decrease to 0.1% considering that last month was 0.2%

- At 16:30 (GMT), the President and Chief Executive Officer of the Federal Reserve Bank of Cleveland will have a speech for the monetary policy

- At 18:00 (GMT), the Financial Management Service of the USA (FMS) will announce their Monthly Budget Sentiment

- Those figures summarize the financial activities of Federal Entities, Disbursing Officers, and Federal Reserve banks

- The result is forecasted to Increase to -150B considering that last month was -235B

On the Charts

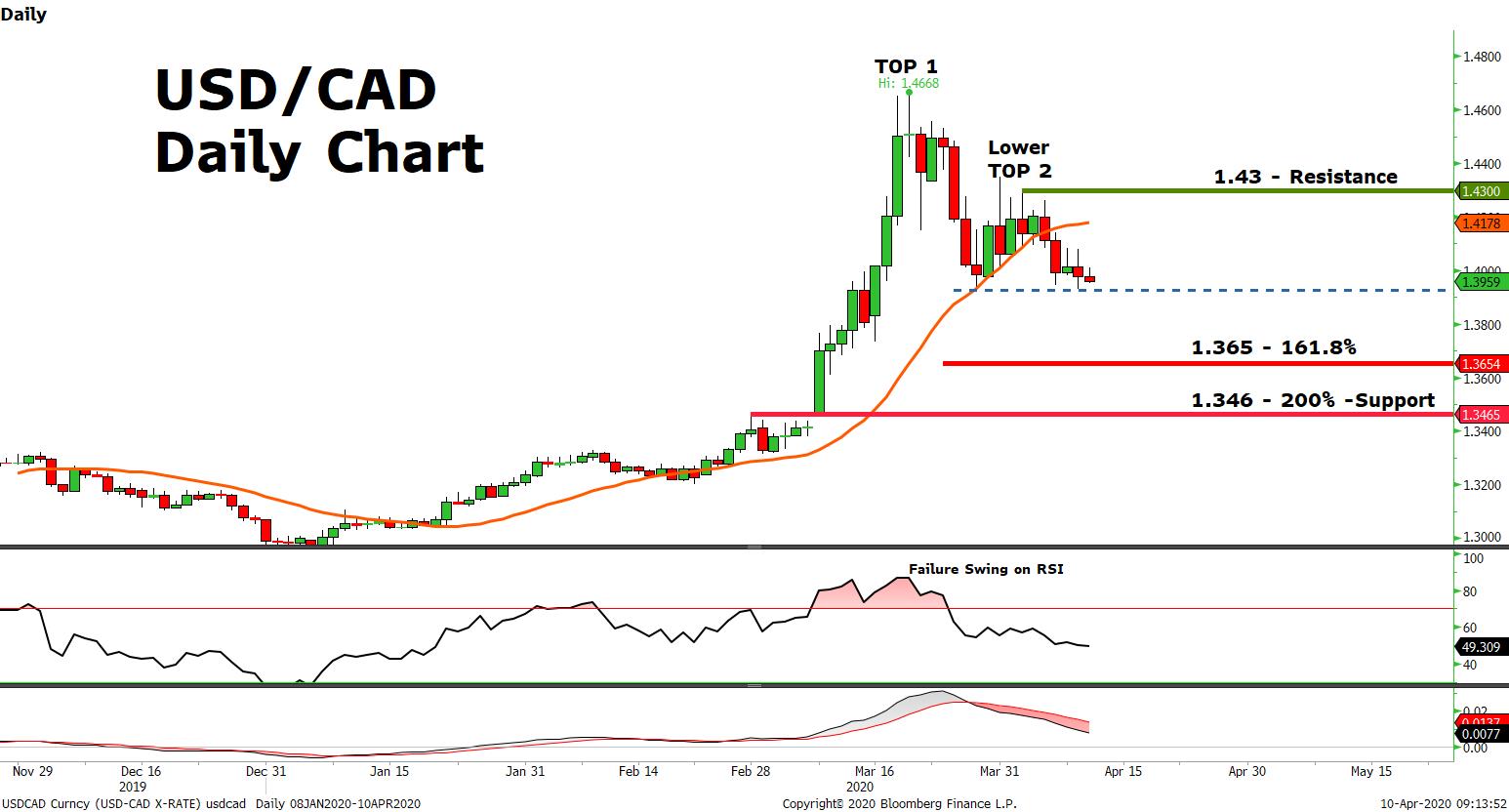

- The USD/CAD price is at 1.3959

- The pair is ready to complete a Failure Swing Reversal Formation since it created a lower Top at 1.43, considering that the previous Top was at 1.4668

- The price is testing the previous support level (blue dashed line)

- Price is below the 20 days Moving Average

- The RSI is slightly below 50 after forming a Failure Swing in its Extreme levels (above 70), and the MACD is approaching the zero line

- If we notice a break below the blue dashed line, there is a possibility to see the price going lower to 1.365, the 161.8% Fibonacci Extension level (From 1.3959 to 1.43) or lower to 1.346, a level which consists an inside support and the 200% Extension Level (From 1.3959 to 1.43)

- Otherwise we may see the price moving higher to 1.43, the previous resistance level