- In the Economic calendar of today we can expect some volatility in Crude Oil and USD

- At 12:00 (GMT) the Organization of the Petroleum Exporting Countries (OPEC) will have a meeting.

- OPEC’s target is to coordinate and unify the petroleum policies of its Member Countries and ensure the stabilization of oil markets

- At 15:30 (GMT) the US Department of Labor Statistics will release their Consumer Price Index (CPI) Ex Food & Energy

- The above is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services

- The result is forecasted to increase to 0% considering the last month that was at -0.4%

- At 17:30 (GMT) the Energy Information Administration of US will release the Crude Oil Stocks change

- The result is forecasted to increase to -1.45M considering the last month that was at -2.077M

- At 21:00 (GMT) the Board of Governors of the Federal Reserve will announce their decision for the Interest rate

- The last decision of the interest rate was at 0.25%

On the Charts

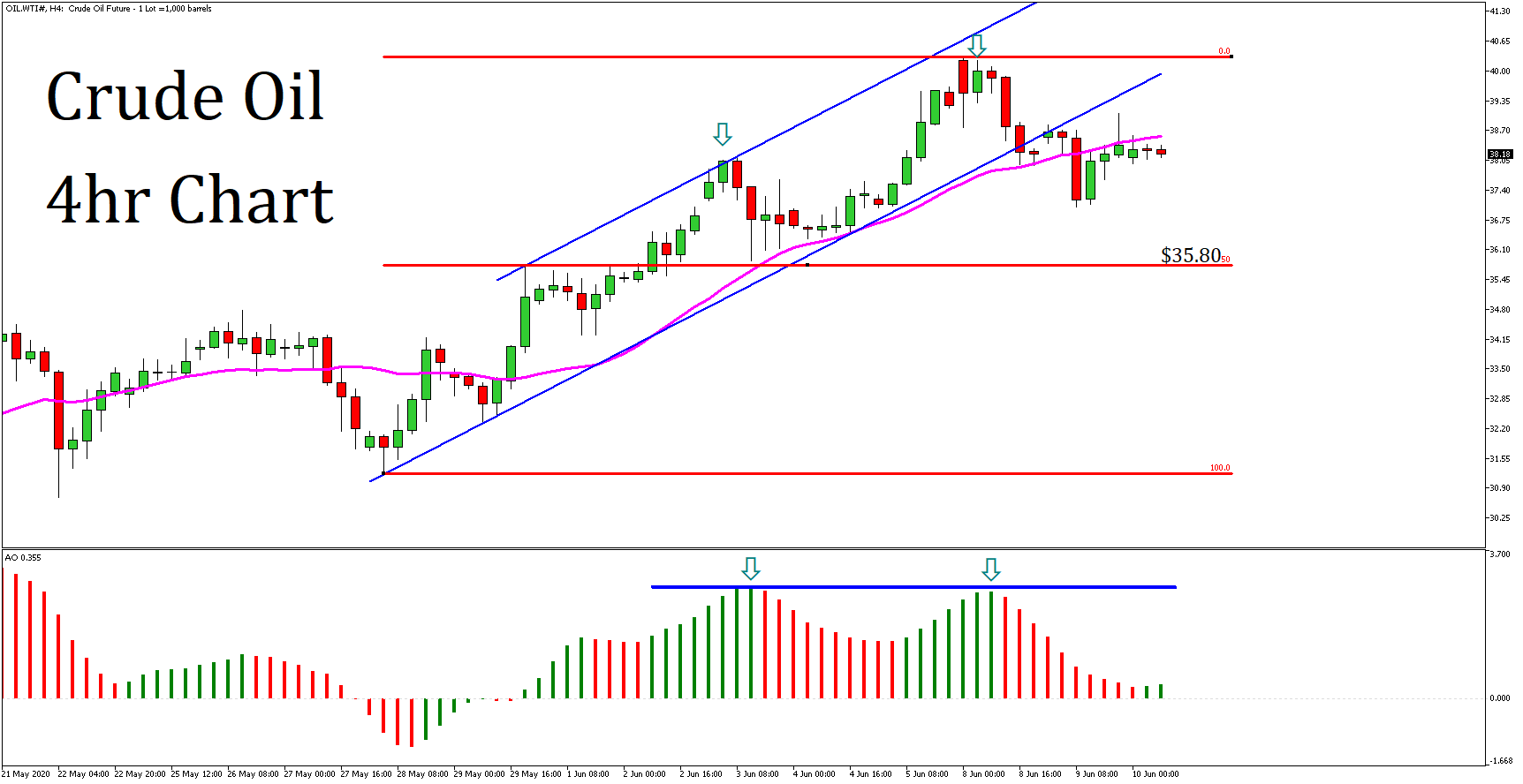

- As we can observe on the Crude Oil 4hr chart, the price has broken below the nice upward trading channel that formed since the last days of May

- The tried to retest the channel but it reacted to the downside on the 20 periods Moving Average

- The price is now below the Moving Average, at 38.18

- A Double Top reversal formation can be observed on the Awesome Oscillator combined with a negative divergence with the price, since even though the price created a new top, the oscillator failed to achieve it

- Considering the above we may see the price moving lower to 35.80, a level which consists the 50% Fibonacci Retracement Level (31.21 – 40.31), an inside and a previous support level