- In the Economic calendar of today we can expect some volatility in EUR and USD

- At 10:00 (GMT) the 27 Finance Ministers of the members of the European Union will have the EcoFin Meeting

- The Economic and Financial Affairs Council covers areas such as coordinated economic measures, budgetary policies, public finances, capital movements and financial markets

- The Ecofin can also gather the only 17 members of the Euro Area to examine measures related to the Euro and the EMU

- At 15:30 (GMT) the US Department of Labor will release their Initial Jobless Claims

- The above is a measure of the number of people filing first-time claims for state unemployment insurance

- The result is forecasted to decrease to 1550K considering the last month that was at 1877K

On the charts

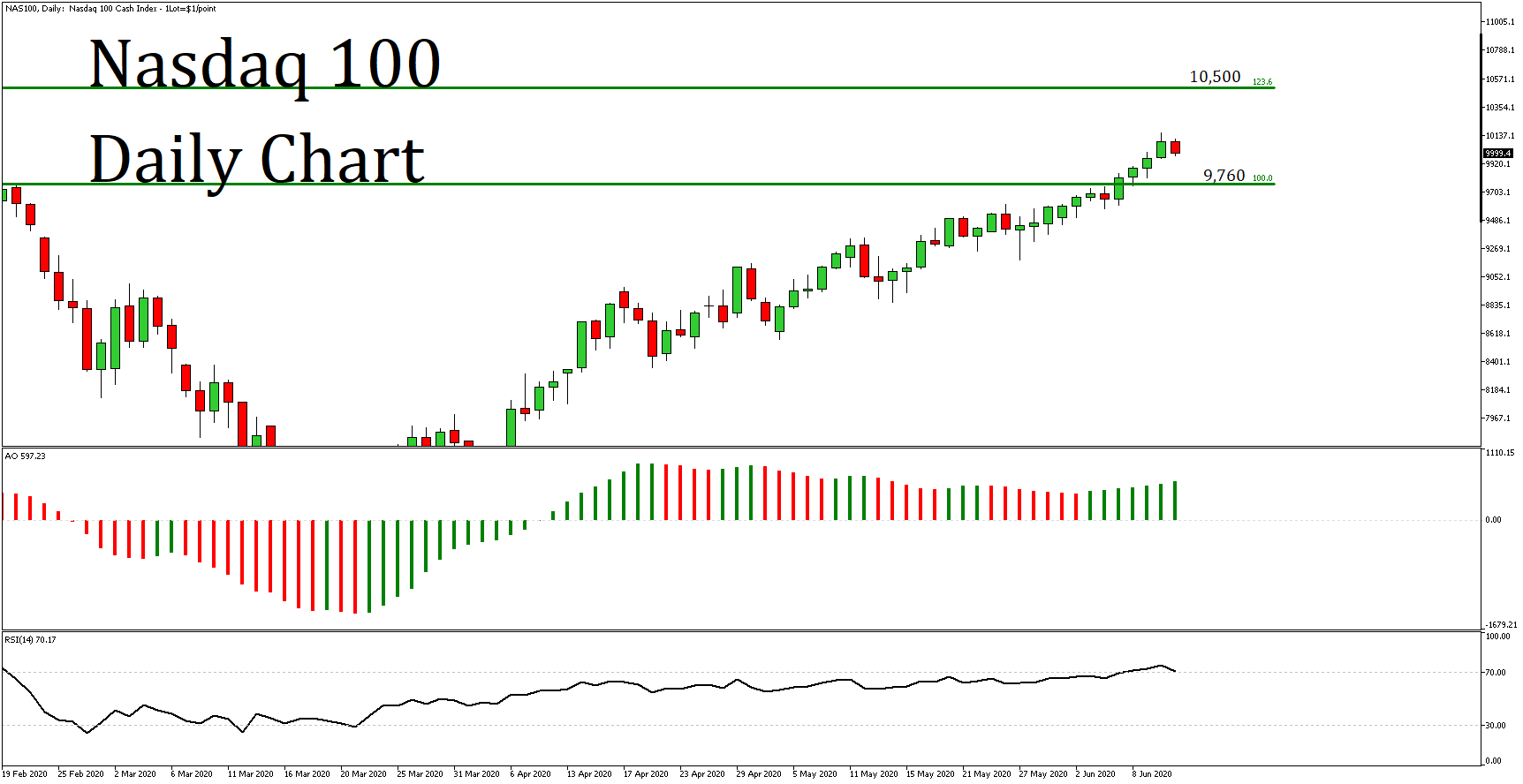

- As we can observe on the Nasdaq 100 Daily chart, the price for first time in history has broken above the 10,000

- Yesterday the price created a new all-time high, at 10,160

- The price – as it was expected – reacted to the downside, since 10,000 consists a strong psychological level, and is now at 9,999

- The Awesome Oscillator (AO), for the last 20 days is moving sideways, in contrast with the price that is moving to the upside creating a negative divergence

- RSI is already above its overbought area and turned to the downside

- Considering the above, there is a possibility to see further downside reaction till the inside support at 9,760

- Otherwise, we may see the price moving to the upside to 10,500, a price level which consists the 123.6% Fibonacci Extension Level (From 9760 to 6622)