- In today’s Economic Calendar we can expect some volatility in the USD

- At 12:30 (GMT) the Department of Labour Statistics of the USA will announce their Import Price Index

- That numbers measure the changes in the price of imported products into the USA

- The result is forecasted for an increase to 1.1%, considering that last month was 0.3%

- At 14:00 (GMT), the University of Michigan will announce the results of their survey in respect to the Consumer Sentiment Index

- That survey determines whether or not consumers are willing to spend money

- The outcome is forecasted a decrease to 95, considering that the last 15 days was 95

- Yesterday, Donald Trump decided to impose a travel ban from many European countries to the USA for a period of 30 days due to the Coronavirus

- The European Central Bank (ECB), has decided to keep unchanged their Deposit Interest Rate at -0.5%

- Dow Jones 30, Nasdaq 100, S&P 500: +4%

- UK FTSE 100: 4.43%

- DAX 30: 1.88%

- Euro Stoxx: 1.95%

- Spanish IBEX: 2.53%

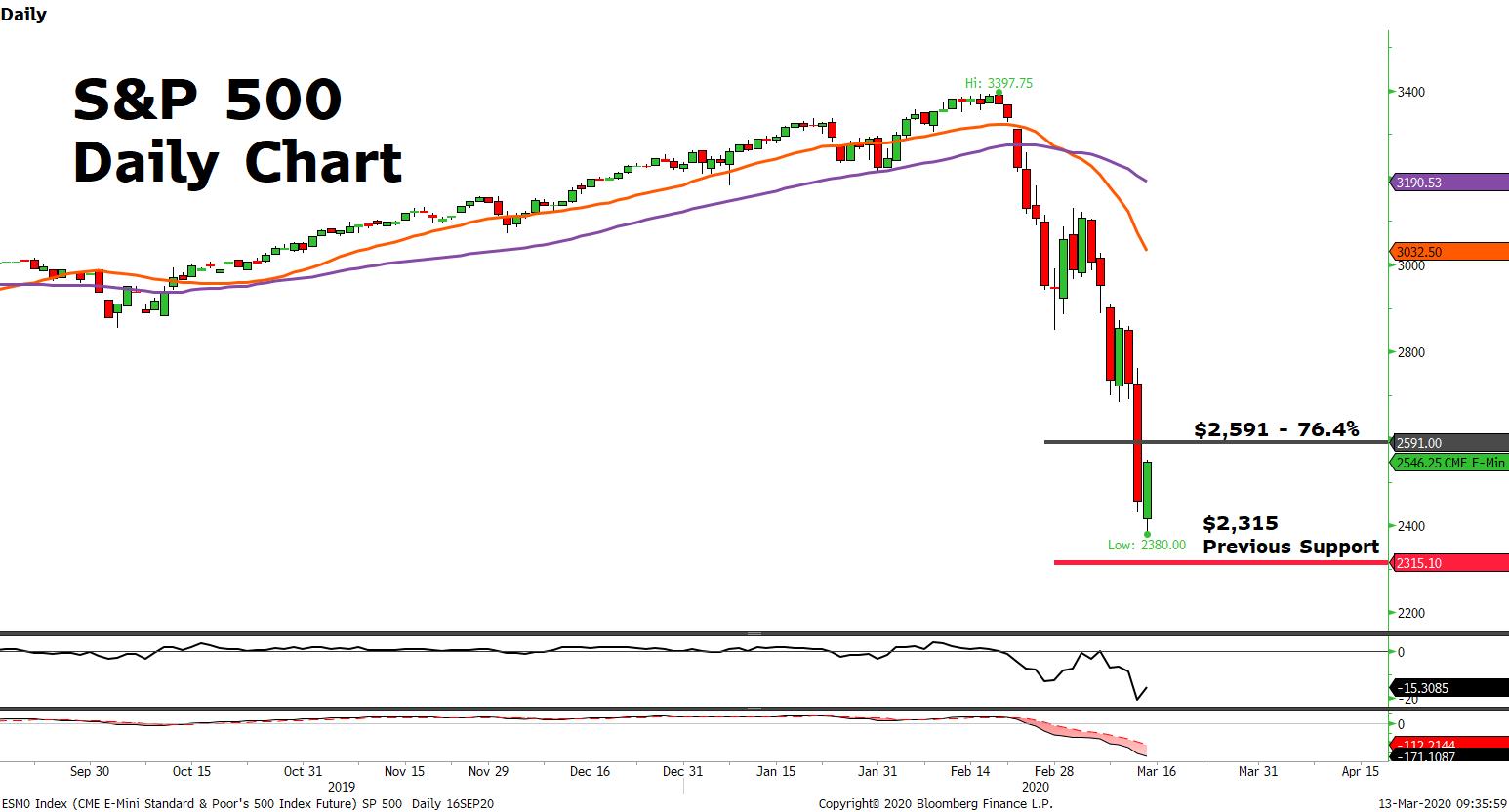

On the Charts :

- The S&P 500 Index fell almost 9.5% in yesterday’s trading session, and 25% since February’s top high which was at $3,393

- Now the price is at $2,546, and it’s testing the 76.4% Fibonacci Retracement level (From 2344 to 3393) at 2591

- Price is below the 20 (Orange) and 50 (purple) days Moving Averages (MA)

- The 20 days MA crossed to the downside the 50 days MA

- Momentum remains bearish since Rate of Change (6 periods) and MACD are both below zero

- If the price remains below the $2,591 mark, we may observe the price dropping to the previous support and December 2018’s low at $2,315

Source : FXGM Investment Research Department / Bloomberg