- In today’s Economic calendar we can expect to see some volatility in the EUR and USD.

- At 06:00 (GMT), Eurostat, the Statistical Office of European Union announced the Harmonized Index of Consumer Prices (HICP) for Germany

- The HICP is a measure of prices used by the Governing Council of EU to define and assess price stability in the Euro zone area in quantitative terms.

- The result remained unchanged as the previous month at 0.8%.

- At 12:30 (GMT), the United States Department of Labor will release their Initial Jobless Claims for the previous week.

- The result is forecasted in a decrease to 2500K, considering that last week was at 3169K.

- AT 15:00 (GMT), Luis De Guindos, Vice President of the European Central Bank will give a speech.

On the Charts

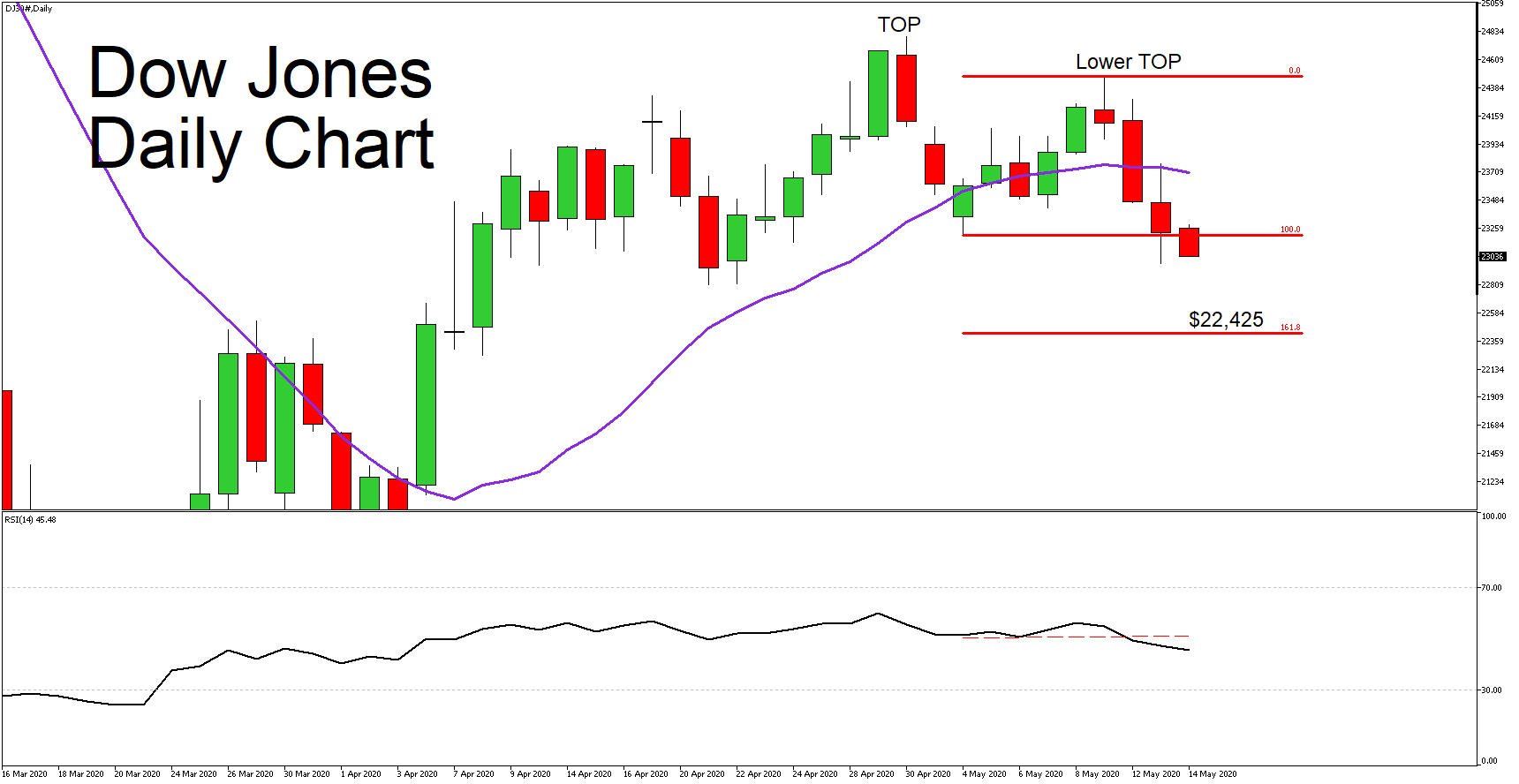

- As we can observe on the Dow Jones Daily chart, the price has formed a failure swing formation, since the last top is lower than the previous one.

- The price is now at $23,083 below the previous support.

- The price is also below its 20 days Moving Average, which it broke and retested.

- The momentum indicator, RSI is below 50 at 45, while its price broke to the downside support (red dashed line).

- Considering the above, if the price closes below its support (blue line), we may see it moving lower to $22,425, a price which consists the 161.8% Fibonacci Extension Level (From 23,204 to 24,475) and an inside support.