- In the Economic calendar of today we can expect some volatility in EUR, GBP, CAD, and USD

- At 09:00 (GMT) the Federal Statistical Office of Germany announced their Producer Price Index

- The above measures the average changes in prices in the German primary markets

- The result has increased to -0.4% considering the last month that was at -0.7%

- At 09:00 (GMT) the National Statistics office of UK announced their Retail Sales

- The result has increased to 12% considering the last month that was at -22.6%

- At 12:30 (GMT) the Statistics office of Canada will announce their Retail Sales

- The above shows all goods sold by retailers based on a sampling of retail stores of different types and sizes

- The result is forecasted to decrease to -15.1% considering the last month that was at -10%

- At 17:00 (GMT) the Chairman of Federal Reserve of USA, Jerome H. Powell, will give a speech

- His words may affect the trend of USD in the short term

On the charts

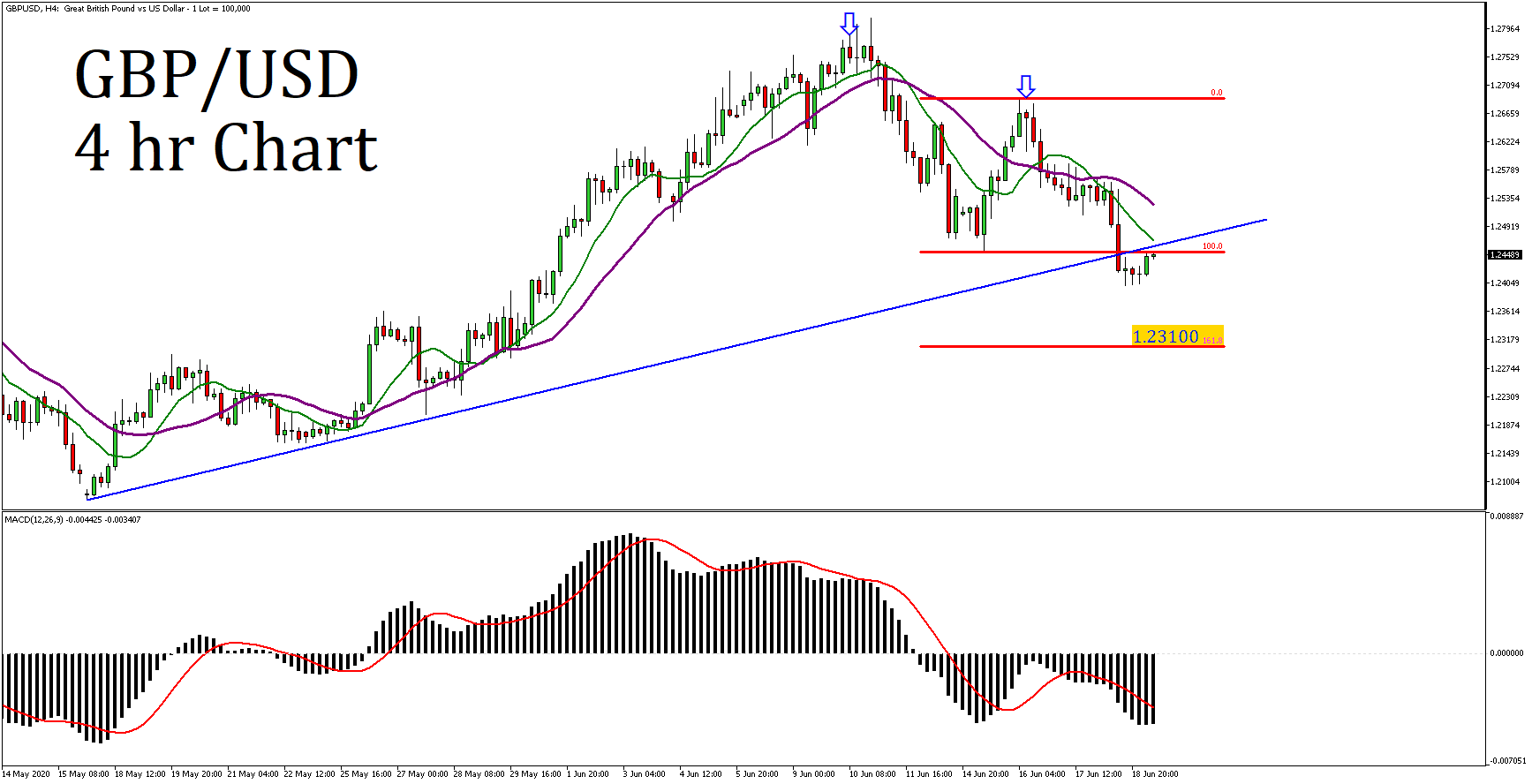

- As we can observe on the GBP/USD 4-hour chart, the price has formed a failure swing reversal formation

- The price has broken below the blue upward trendline

- The previous resistance has been broken and is now retested

- The price is now at 1.24489, below the 10 (green) and 20 (purple) periods moving averages

- The 10 periods crossed to the downside the 20

- MACD and its signa line are both below zero, while MACD has crossed the signal line to the downside

- Considering the above we may see the price moving lower to 1.23100, the 161.8% Fibonacci Extension Level (From 1.24534 to 1.26892) and a previous support level