- In the Economic calendar of today we can expect some volatility in GBP, EUR, and USD

- At 09:30 (GMT) the Governor of the Bank of England, Andrew Bailey, will give a speech

- His words may affect the GBP in the short term

- At 12:00 (GMT) the Statistical office of European Union will release the Harmonized Index of Consumer Prices (HICP) for Germany

- The HICP is a measure of prices used by Governing Council of EU to define and assess price stability in the euro area in quantitative terms

- The result is forecasted to increase to 0.6% considering the last month that was at 0.5%

- At 14:00 (GMT) the National Association of Realtors of USA will announce their Pending Home Sales

- The above captures residential housing contract activity of existing single-family homes

- The result is forecasted to increase to 19.9% considering the last month that was at -21.8%

On the charts

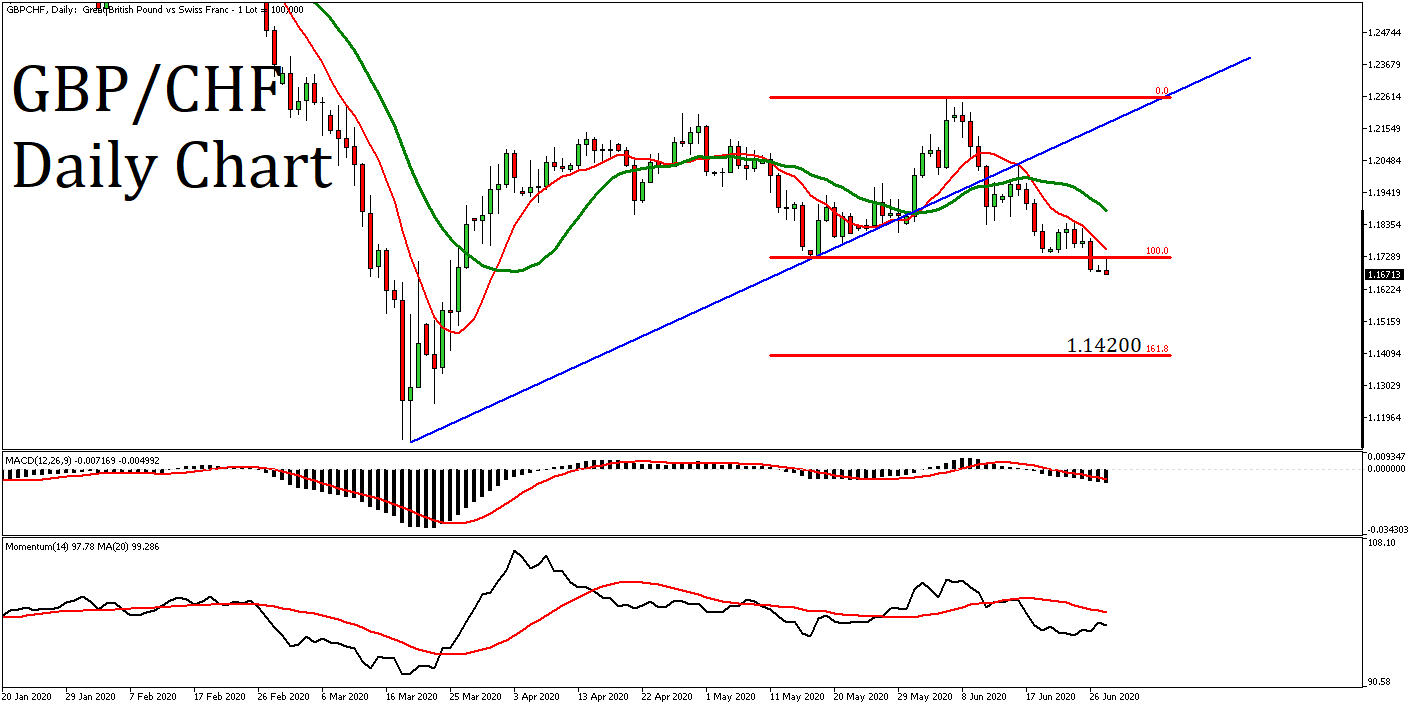

- As we can observe on GBP/CHF daily chart, the price has broken below the blue upward trendline, retested it and moved to the downside

- Recently, the price has broken below the previous support and is now at 1.15739

- Price is below the 10 (red) and 20 (green) days Moving Averages

- The 10 days crossed to the downside the 20days

- MACD has crossed its signal line to the downside while both are below zero

- Momentum indicator is in downtrend while is below its 20 days Moving Average

- Considering the above, we may see the price moving lower to 1.14200, the 161.8% Fibonacci Extension Level (1.17279 – 1.22580)