- In the Economic calendar of today we can expect some volatility in EUR, CAD, and USD

- At 09:00 (GMT) the Eurostat (European Statistics office) will release their Consumer Price index

- The above captures the changes in the price of goods and services

- The result is forecasted to decrease to 0.2% considering the last month that was at 0.3%

- At 12:30 (GMT) the Statistics office of Canada will announce their Gross Domestic Product

- The above is a measure of the total value of all goods and services produced by Canada

- The result is forecasted to decrease to -10% considering the last month that was at 0.3%

- At 12:30 (GMT) the US Bureau of Economic Analysis will release their Goods Trade Balance

- The above is the difference in value between imported and exported goods during a certain month

- The previous month the result was at -$64.38B

On the charts

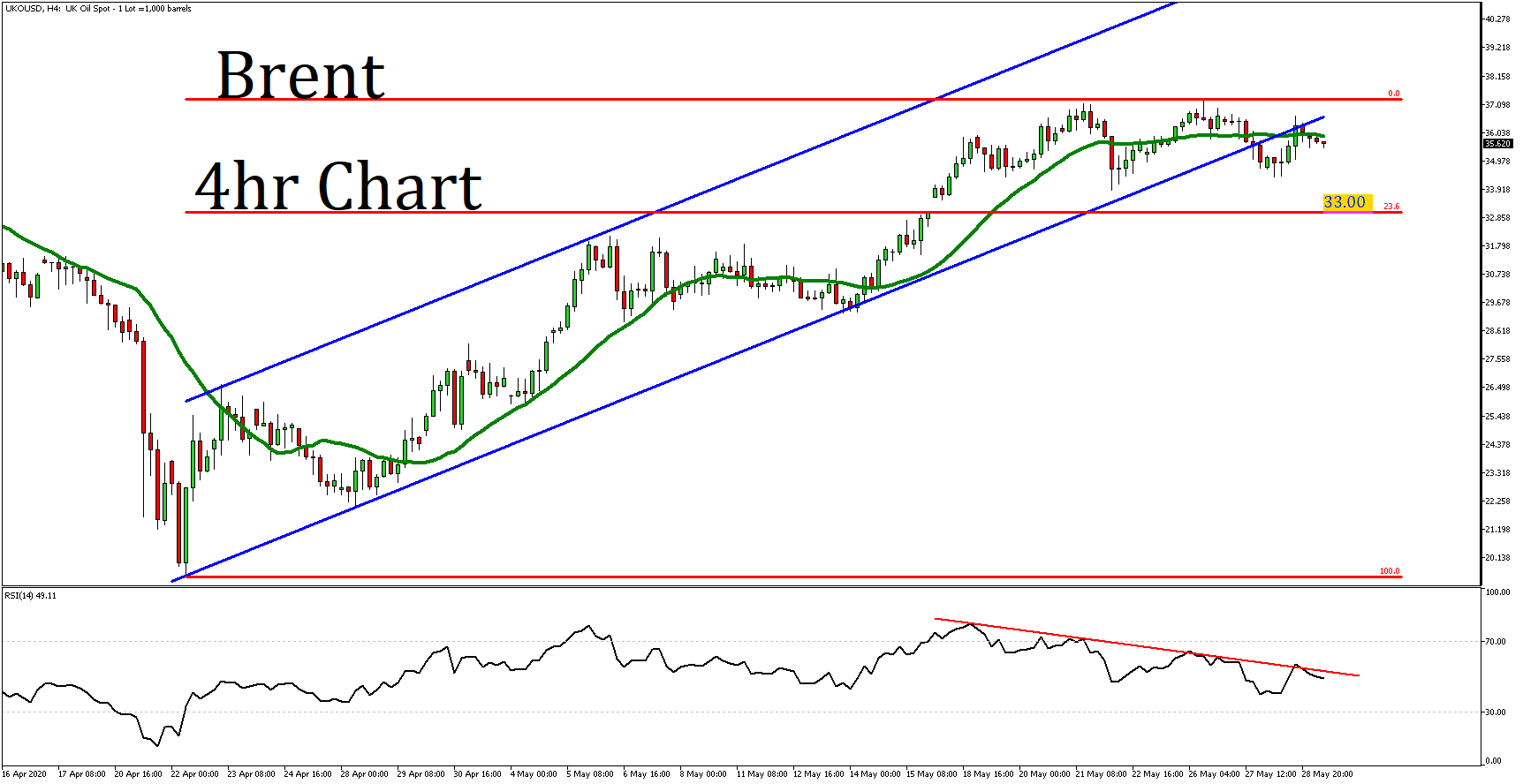

- As we can observe on the Brent 4hr chart the price has been traded in an upward trading channel since 22 of April

- The commodity found twice resistance at 37.250

- The price has broken below the upward trading channel and retested it

- Now is at 35.620, below the 20 periods Moving Average (green)

- On the RSI we can observe a negative divergence combined with a downward trendline (red) while to momentum indicator is at 48

- Considering the above there is a possibility to see the price moving lower at 33, a price live which consists the 23.6% Fibonacci Retracement Level (From 19.411 to 37.284)