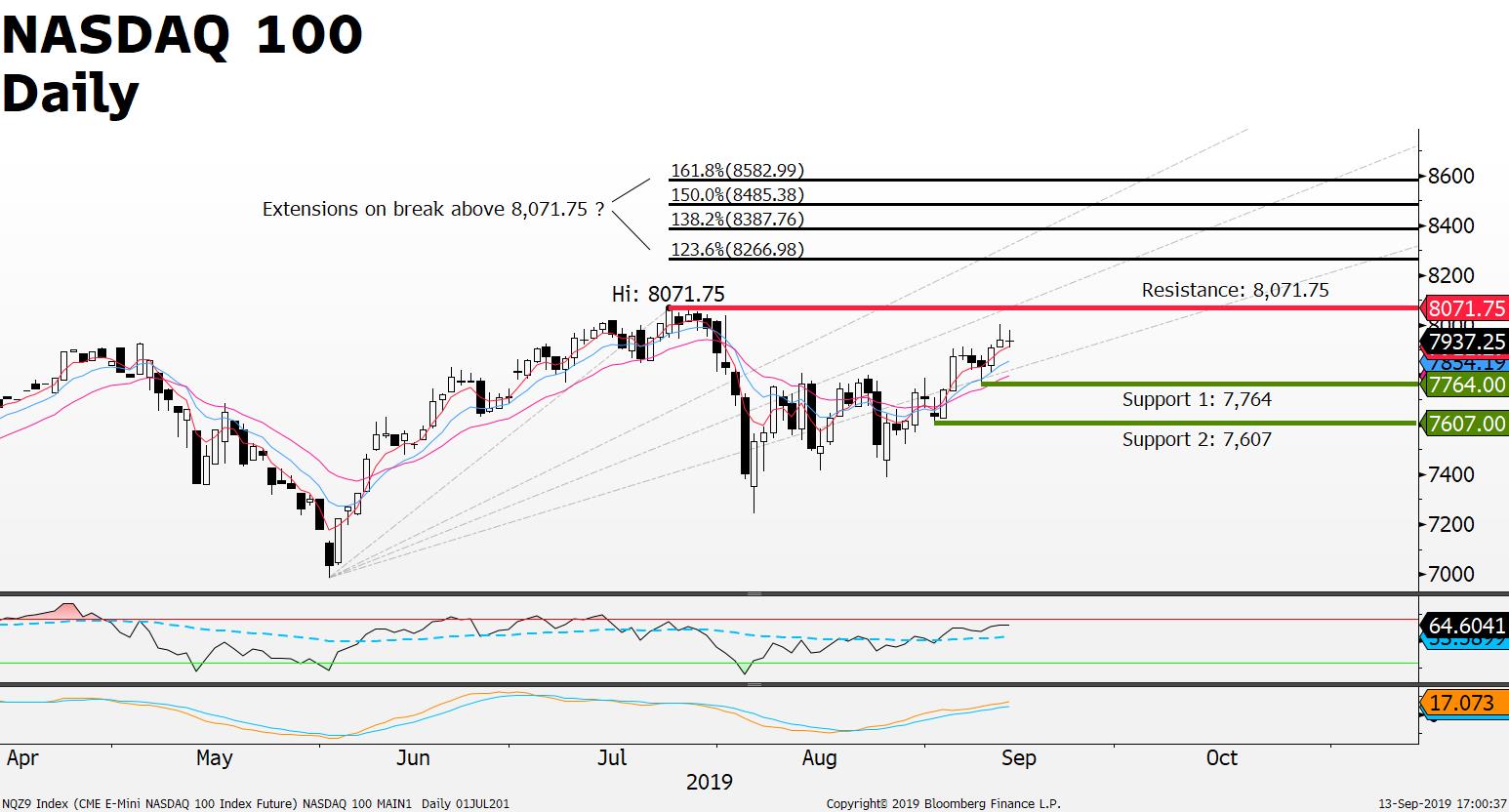

NASDAQ 100 potential upside break-out

Climbing higher on bets US multi-year bull market will continue as US set to cut interest rates again

Trend Analysis: Potential upside breakout (Daily Chart)

Headline: US, EU rate cuts , China economic stimulus, US-China pull back on trade tariffs all creating positive risk on mood for investors

Assets Description: The NASDAQ-100 Index is a index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ.

The index has gained has gained +25% last 9 months days and +5% last 30 days.

Expected US Interest Rate Cut on Wednesday

- US FED Interest rate decision and FOMC meeting set for September 17th – 18th next week;

- US Interest rates forecasted to be cut on Wednesday from 2.25% to 2%;

Stock Indices positive last 30 days

- The July – August stock market downside correction is over as the US Dow Jones recovers +5.6%; NASDAQ 100 +5%; SP500 +3% , FANGS +7.7% last 30 days;

- Investors seen supporting higher stock markets on speculation lower US Interest rate to keep economy on track and avoid a recession;

Precious Metals higher ahead of US Interest Rate Decision

- Silver moves +7% last 30 days outperforming Gold;

- Precious metals become more in demand on concerns that lower USD interest will make hard assets more attractive to own;

USD Dollar weakens on bets US FED to cut Interest rates

- EUR/USD correcting higher after falling since June; the current upside move was triggered after the EUR/USD dropped -100 pips to test the 1.0926 support on the back of the European Central Bank (ECB) announcement to cut the deposit rate to -0.5%; buyers saw the opportunity to step in and buy EUR/USD at the 1.0926 support; move now seen as technically driven for a potential further upside retracement to test the June - September 38.2% - 61.8% retracement levels between 1.1112 and 1.1226;

- GBP/USD retraces higher after multi-month fall; GBP/USD jumps +3% last 30 days on bets of a no-deal Brexit; GBP/USD current price finds resistance at 1.2450 a break above opens up potential for further price advance towards the June – August 50% - 61.8% retracement levels spotted near 1.26 and 1.2738;

Crude Oil (CL) remains range bound, Oil (CL) hits resistance at $58.90

- Current Oil price at $55.30 remains within a multi-week trading range as oil traders try to position themselves ahead of the next major break-out;

- Iraq struggling to reduce production;

- Saudi Arabia replaces its energy minister

- US crude oil inventories reductions adds some price support, price hits resistance at $58.90 now seen as the upper level while closest support sits near $53

Source: FXGM / Bloomberg