Market Drivers

- Asian technology stocks jump higher in overnighter trading supported on news that the US may delay the ban on Huawei, China’s largest tech company from US markets according to Bloomberg;

- Asian, European and American stock indices get price support as Investors shift back into risk assets on speculation global central banks will move towards lower interest rate policies to offset the negative effects of the US global trade war;

- WTI (CL) Crude Oil current price $53.85; holding above $51.70 support on reports that US Crude Oil Inventories may have declined since last week, while Russia issues a warning of weakening Oil supply;

- US Dollar weakens on speculation of lower US interest rates; Commodities prices seen getting a boost on the weaker USD;

- Silver prices seen supported on supply concerns with reports that China has been aggressive in buying silver for industrial demand; Silver has been underperforming Gold prices on global trade war fears; Silver current price holding just near the $14.70 support level;

Charts

European stock market set to get a boost higher after the Asia session moved higher on “easing” trade war tensions and bets that China will add further stimulus to keep China’s growth moving; German Dax current price 12,131 + 139.5 points last 5 days; resistance spotted at 12,212 a move above may trigger the end to the recent downside correction and back into its longer term uptrend.

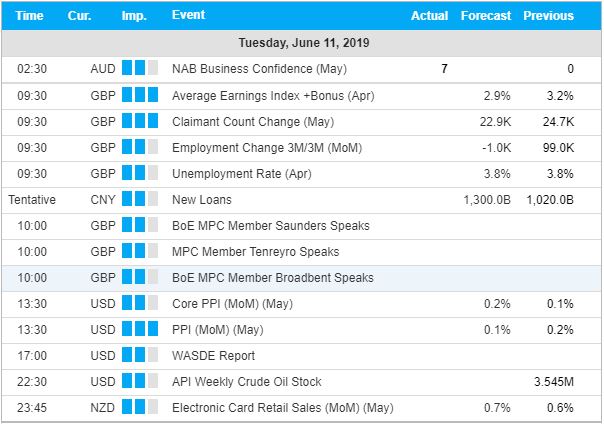

EUR/ USD struggling to break and hold above the 1.1315 resistance; current price 1.1317 however weakening upside momentum indicates buyers may not be convinced a further upside move is justified; today’s US Producer Price Index (PPI) data could be the next EUR/USD catalyst to determine the EUR/USD next move; upside potential towards 1.1375 to 14.50 remains provided prices can hold above the 1.1315 resistance, otherwise a retest of the 1.1155 support can not be ruled out.