Market Drivers

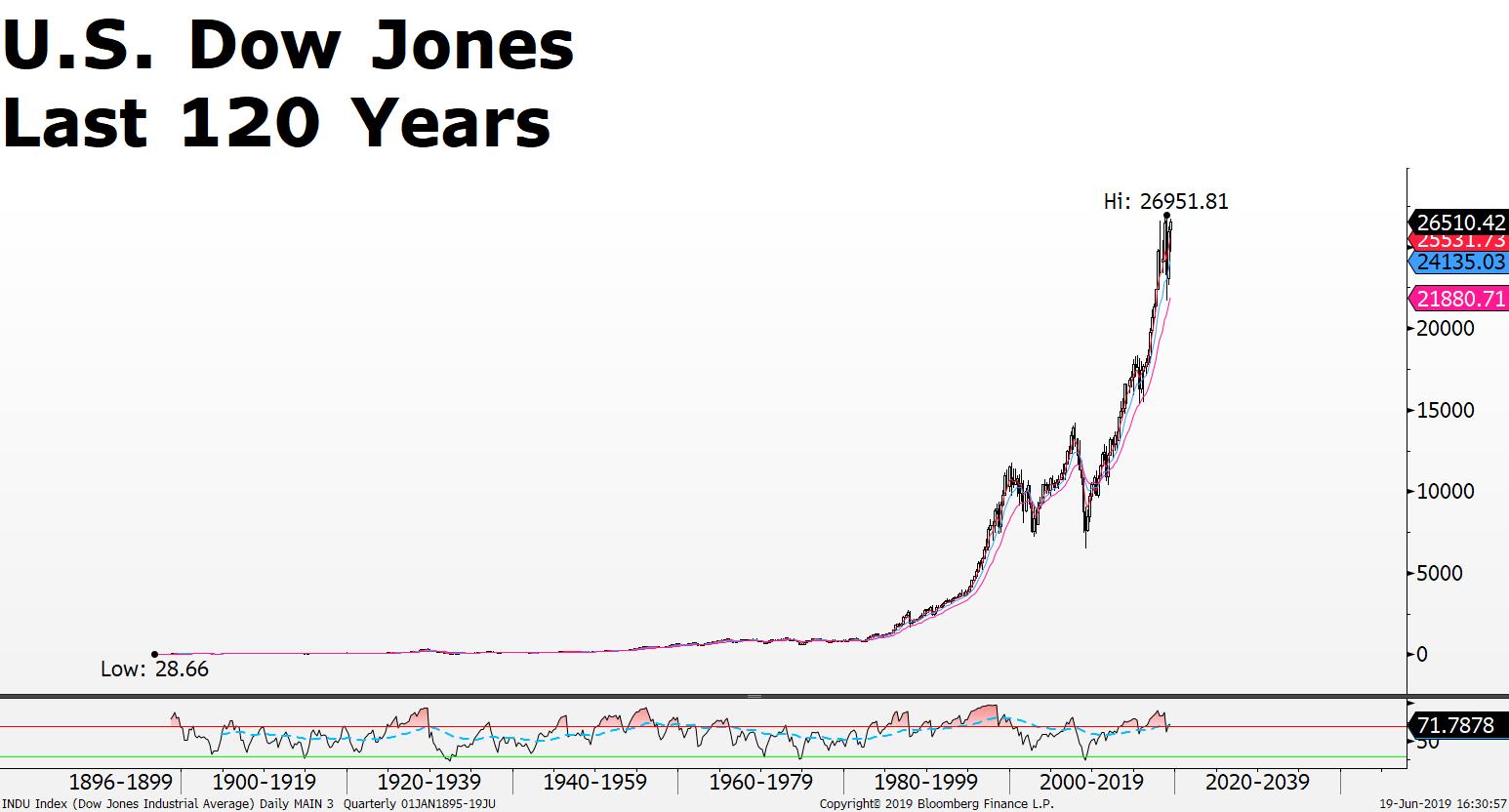

- Investors expect the US Fed to lower interest rates in September because they believe stocks will fall if they don’t; Dow Jones 30 needs to clear above 26,533 to open up the potential for an attempt at hitting a new all-time historic highs;

- Gold and Silver lower ahead of the US interest rate announcement; Gold down -$4.2 , Silver down - 0.5%; however gold and silver current prices remain bullish on the daily chart; indications of USD interest rate cuts today could drive up the price of precious metals, speculative reward/risk trade to buy gold and silver on weakness and sell into and potential strength over the next 48 hours.......

- S&P 500 within 1% of all-time high as markets price in interest rate cut;

- US Crude Oil Inventories and US Interest Rate Decision; the US Fed will shift towards lower interest rate policies is helping stock markets across the EU and US approach near all-time historic highs;

- Crude Oil speculators boost Oil prices higher with WTI (CL) jumping +5.6% higher over the last 5 days on bets of improving outlook between the US-China trade war; Energy prices also finding short term support on expectations that lower US and EU interest rates will help boost global demand for Crude; CL current price $53.90 +5.6% last 5 days; support $50.20; resistance $55.85; due today – US Crude Oil Inventories forecasted to fall -1.077 million barrels;

Charts

The NYSE FANG+ Index is an index designed to represent a segment of the technology and consumer discretionary sectors consisting of highly-traded growth stocks of technology and tech-enabled companies such as Facebook, Apple, Amazon, Netflix, and Alphabet's Google.

SP500 +40.75 points last 5 days on expectations that the US Federal reserve move make a move to lower US interest rates to support a slowing US economy; current price 2923.25; resistance 2932.75; support 2812.75; a break above 2932.75 opens up potential price extension towards 3019 and 3103; otherwise is price fails to hold above 2932.75 a test of the 2812.75 support can not be ruled out.

Silver price +3.5% last 30 days on expectations that the US Federal reserve move make a move to lower US interest rates thereby adding downside pressure on the US Dollar while making precious metals prices more attractive to non-USD investors; current price $14.98; upside $15.25 to 15.45; downside near $14.70 support. Upside momentum remains intact since RSI is above its signal line (Bullish), current price is above its 4,9 and 18 period moving averages (bullish); current price has broken towards the upside of the multi-month previous downward trendline (Bullish)

Source: FXGM / Bloomberg