Global Central banks shifting towards lower interest rate policies?

- Weaker US Dollar; Falling Oil Prices; higher Precious Metals;

- Stock Markets at make or break point;

Today’s Market Drivers

**FLASH UPDATE: REPORTS THAT A SAUDI OIL TANKER WAS ATTACKED ; CRUDE OIL JUMPS 3.5% ON THE NEWS!!!!** (Source Bloomberg)

- Swiss National Bank (SNB) Interest Rate Decision forecast to remain unchanged at - 0.75%; CHF (Swiss Franc) vulnerable to any surprise in policy shift; traders may be put into a situation to chase the CHF higher or lower today...

- 10am GMT+1 Eurozone Industrial Production forecast to fall from -0.3% to -0.5% ; measures the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. A higher than expected reading should be taken as positive/bullish for the EUR, while a lower than expected reading should be taken as negative/bearish for the EUR.

- 13:30 GMT+1 US Import Price Index forecast to fall from 0.2% to -0.3%; the Import Price Index measures the change in the price of imported goods and services purchased domestically. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Charts

Precious Metals; Gold; Silver; Platinum all higher last 5 days after Weak US inflation data supports the case for the US FED to lower interest rates; lower US interest rates weakens the USD thereby making precious metals more attractive as a store of wealth and to hedge bets of low inflation; Silver prices holding above $14.7 support after breaking to the upside of the multi-month downtrend; current price $14.80; a push higher towards resistance levels $15.25 to $15.45 can not be ruled out. Good risk reward trade set up provided price can hold above the $14.70 support.

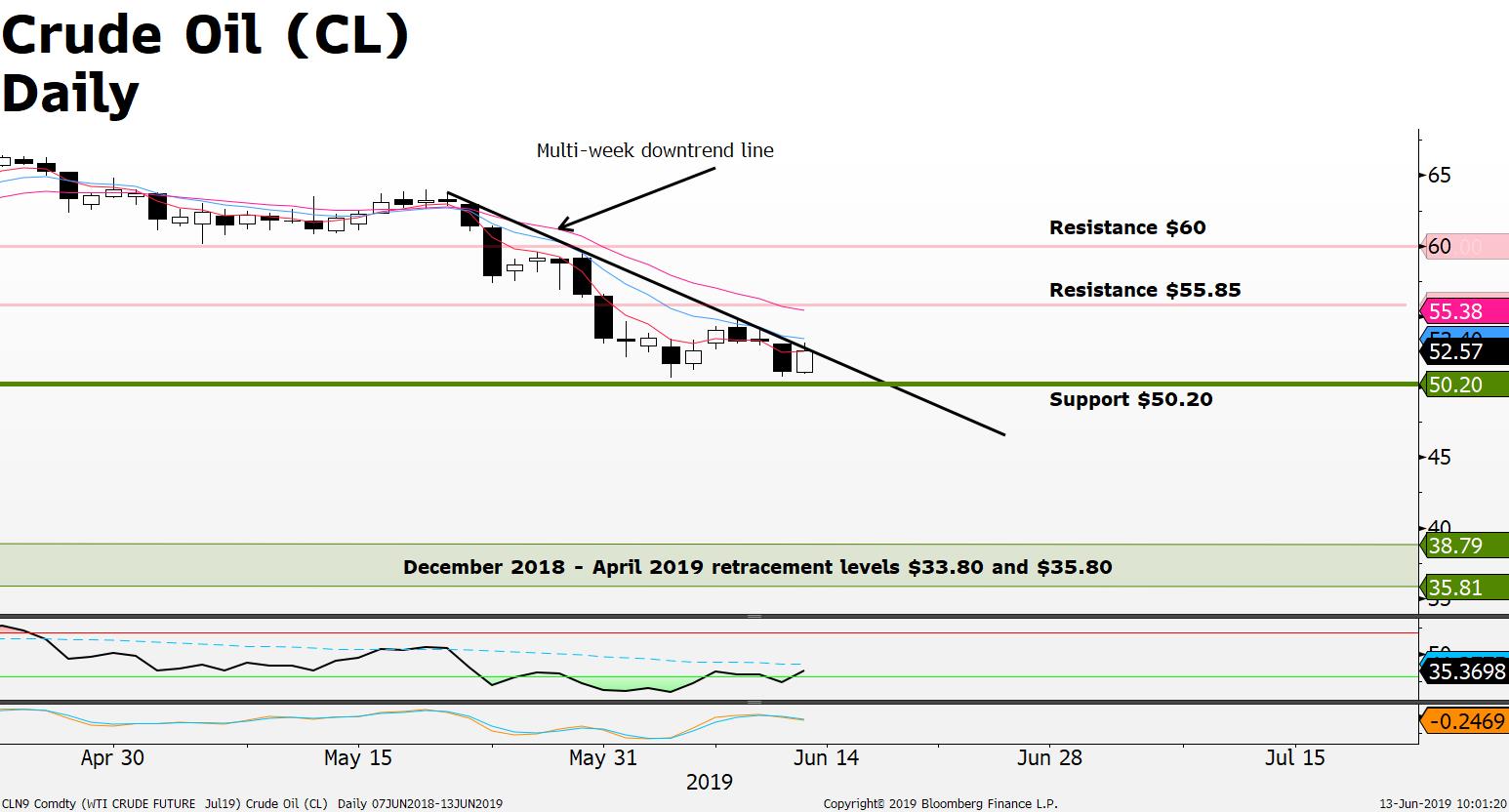

Crude Oil prices spiked higher on Bloomberg reports that a Saudi Oil Tanker was attacked; however the price spike is exposed to a correction since an attack on one taker ship will not result in any major supply disruptions; technically Crude Oil (CL) current price remains below the multi-week downtrend line (Bearish); support at $50.20; resistance $55.85; a break below support opens up further downside; towards the December 2018 – April 2019 retracement levels $35.80 - $33.80.

EUR/ USD pushing higher after US president said that the Euro is 22% too cheap and recent US CPI data shows that US Inflation has slowed building the case for the US FED to cut interest rates adding downside pressure for the USD while lifting the Euro ; EUR/USD testing the 1.1315 resistance; current price 1.13 +25 pips last 5 days; upside 1.1375 to 1.1450 resistance area; supports spotted at 1.1210 and 1.1150.

SP500 Index currently trading above its multi-week downward trendline (Bullish) momentum analysis indicates bullish momentum remains; current price 2876; resistance at 2895 needs to be overcome in order for the SP500 to continue its advanced towards new all-time highs; buyers of the SP500 are speculating that US interest rate cuts will support US stock markets; support zone seen at 2690.50 to 2630; upside remains provide price can break above 2895 resistance;