There is no magic system that will make people money. This is a fantasy. The true purpose of a trading system is to alert the trader to:

- A potential trend reversal - are prices trending higher or lower?

- Filter out “market noise” and attempt to time the right time to buy or sell

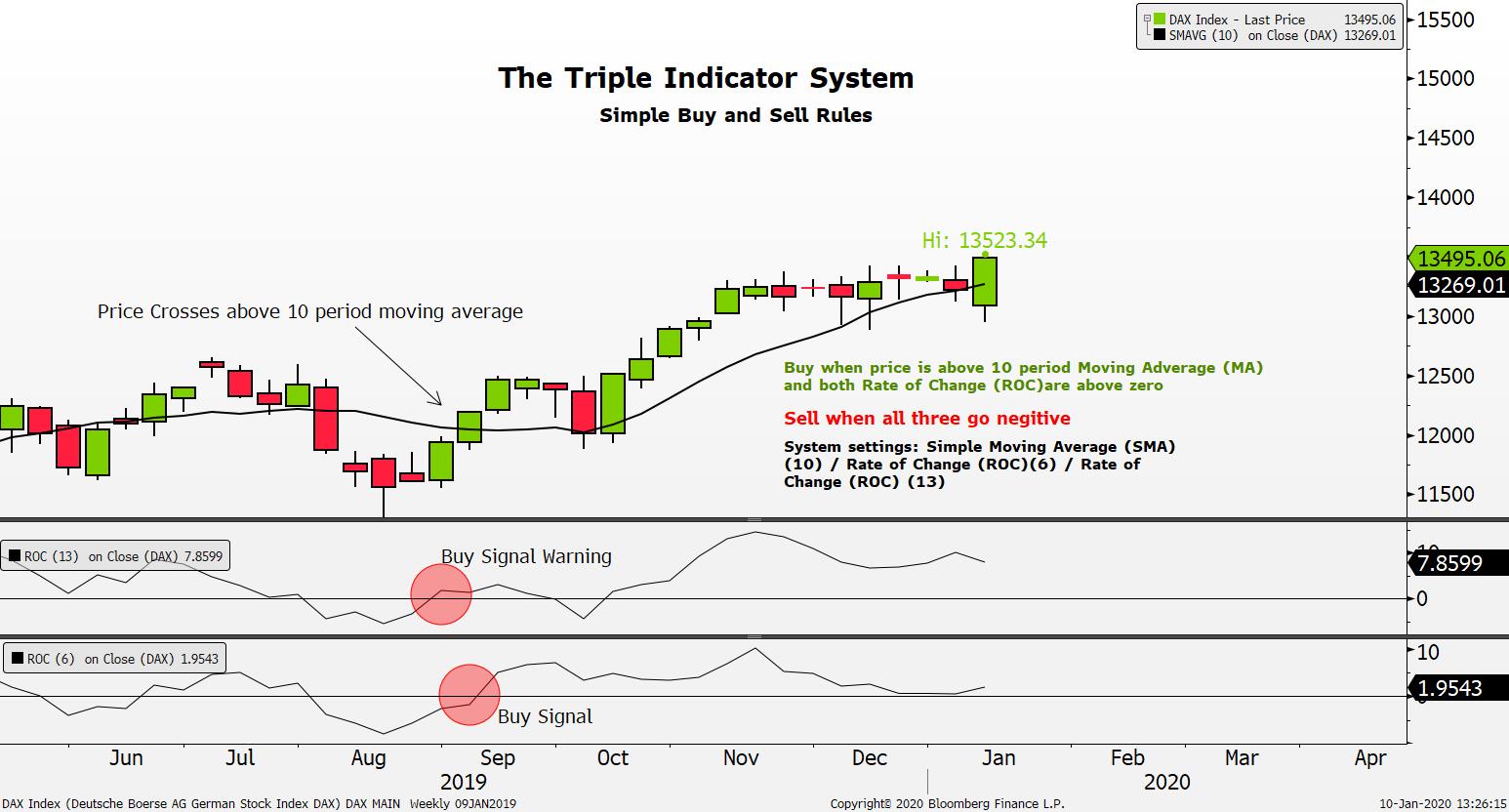

The Triple Indicator System

Uses 3 triggers that incorporates indicators based on 3 different time frames

- Combines a 10 period Moving Average cross over with a signal from 2 separate Rate-of-Change (ROC) indicators using 6 and 13 period values

The Moving Average crossover is a trend following tool while using 2 oscillators for market timing trade signals.

Buy and Sell Signals:

- Buy when price is Above its 10 period Moving Average AND BOTH ROCs are above zero (0).

- Sell when price is Below its 10 period Moving Average AND BOTH ROCs are below zero (0).

Signals cannot be triggered unless ALL 3 agree.

No trading system cannot be complete without a money management plan.

- Money management is the art of limiting risk while maximizing reward

- Its money management that will have the greatest impact on your profits, losses and your reward to risk ratios

Steps to Money Management:

Set your maximum loss for your portfolio

- Have a number in mind for your maximum loss that you can handle and work backwards to find your individual risk per trade

Set your potential reward to potential risk levels

- You should have a clear target area and stop loss levels

- Reward to risk ratio could vary, but it should be more or equal to

Position Size

- It more common than not that most trades will be losses, knowing how to control proper position size is vital to managing risk and maximising results

- Position size = Maximum risk per trade / stop loss in points/pips

Example:

Account equity: $10,000

Trade Value: $200,000

Pip/Point Value: $20

Stop loss: $1,000 (50 pips)

Take profit: $3,000 (150 pips)

Hypothetical situation on 10 trades assuming best and worst case using the above values:

*Hypothetical indicative outcomes not including trading cost.

Record Keeping and review

- Review all trades and keep notes on both winning and losing trades

- Keeping records and reviewing all your trades will help you filter out your good, as well as your bad trading habits (we all have them)

- Build on your strengths and learn from mistakes (we all make them)

Good luck and have a great trading day!