Market Drivers

- Global Central Banks signalling shift to lower interest rates; Precious Metals moving higher; Gold +$19, Silver attempting to start new up-trend

- German DAX finding it difficult to break above 12,212 resistance; the Index remains within the 11,920 and 12,212 two week trading range; traders should be on alert for potential fast market conditions upon a break either above or below the current price range; upcoming ECB president speeches could be the break-out catalyst;

- Australian stocks jumped higher and the Australian dollar fell after Reserve Bank of Australia signalled a shift towards lower interest rates following the US and European trend of lowering rates to help boost economies;

- Bank of England (BoE) Governor and the European Central Bank (ECB) President both due to speak today at separate events; GBP and Euro assets expected to react to any unforeseen comments during these speeches;

Market movers last 24 hours

- Australia ASX 200 stock index +0.6% higher after Reserve Bank of Australia (RBA) indicated to cut interest rates and the AUD/USD fell to five month low

- Japan YEN versus the US dollar +0.26% higher after Bank of Japan Governor said the Global economy risk is to the downside; leading investors into the safety of the Japan YEN;

- Zinc bounces higher after hitting a five month low as fund managers bet against the metal; technical traders may be aiming to sell into the price bounce on speculation that Zinc prices will continue to fall;

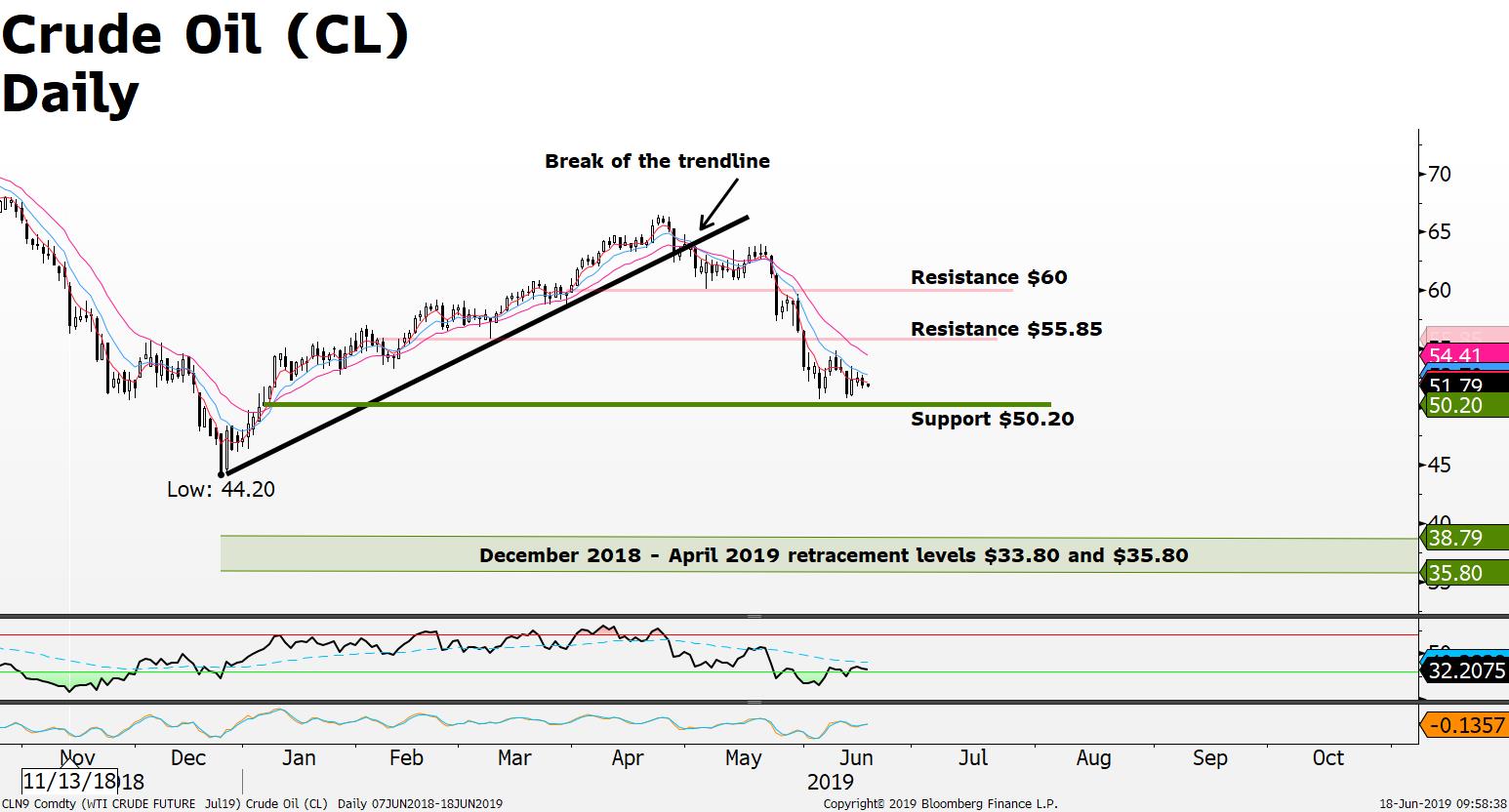

- Crude Oil (CL) prices remain under downside pressure; as OPEC production targets remain uncertain adding to the signal that US economic indicators showing signs of weakening demand for Crude oil; weak US outlook;

Charts

German DAX finding it difficult to break above 12,212 resistance; the Index remains within the 11,920 and 12,212 two week trading range; traders should be on alert for potential fast market conditions upon a break either above or below the current price range; upcoming ECB president speeches could be the break-out catalyst;

Crude Oil (CL) prices remain under downside pressure; as OPEC production targets remain uncertain adding to the signal that US economic indicators showing signs of weakening demand for Crude oil; weak US outlook;

Silver prices holding above $14.70 support ahead of tomorrow’s US Federal Reserve Interest rate Decision;

Economic Calendar Events (All times is GMT+1)

European Central Bank (ECB) President Draghi Speaks; as head of the ECB, which controls short term interest rates, he has more influence over the EUR value than any other person. His comments may determine a short-term positive or negative trend.

German ZEW Economic Sentiment; Economic Sentiment Index gauges the six-month economic outlook. A level above zero indicates optimism; below indicates pessimism. The reading is compiled from a survey of about 350 German institutional investors and analysts. A higher than expected reading should be taken as positive/bullish for the EUR, while a lower than expected reading should be taken as negative/bearish for the EUR.

Bank of England (BOE) Governor Mark Carney is to speak; As head of the BOE's Monetary Policy Committee (MPC) which controls short term interest rates, Carney has more influence over sterling's value than any other person. Traders scrutinize his public engagements for clues regarding future monetary policy. His comments may spark a short-term positive or negative trend.