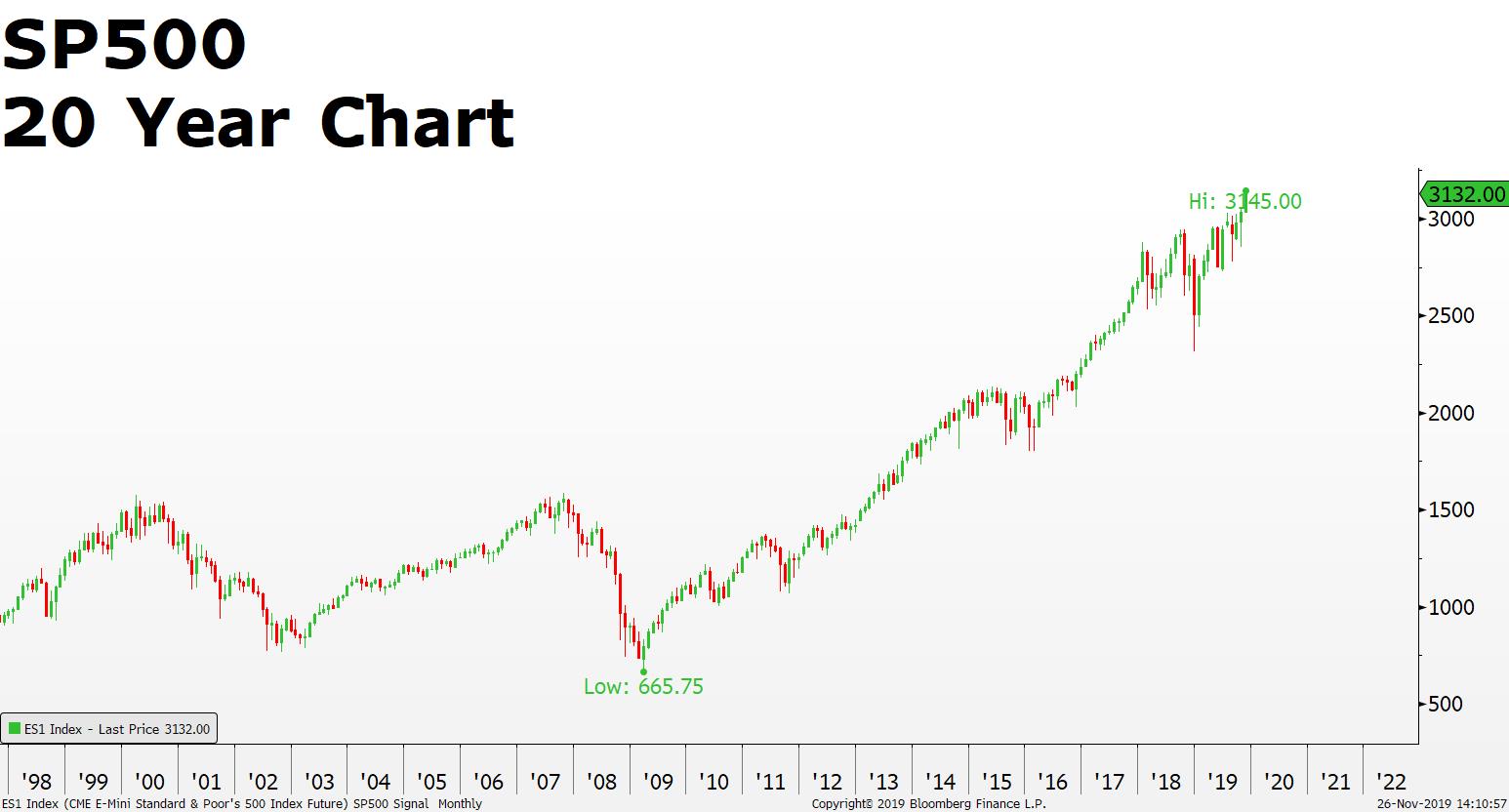

Recent SP500 stock Index Market Drivers:

- US Job Market remains strong;

- US FED cut Interest Rates 3x this year to defend the US economy from the US – China trade war;

- Current US economic policy is positioned to support strong jobs market and boost inflation (US inflation remains below the FED’s 2% target)

Historically increased asset prices add to higher inflation…

Questions?

- Since stocks are assets…will higher inflation prospects lead to even higher stock market prices???? Can the current bull market continue for another 10 years?

Or,

- Will the US FED’s actions create asset bubbles…? bubbles do tend to pop…at some point…

Act on your own view of the direction of US Stock markets with CFD stock Indices:

Dow Jones 30 Index (active contract DOW 20/12/2019)

SP500 Index (active contract SP 20/12/2019)

NASDAQ 100 Index (active contract NSDQ 20/12/2019)

NYSE Fang+ Index (active contract 20/12/2019)

Good Luck and Happy Trading!

Source: FXGM Investment Research Department