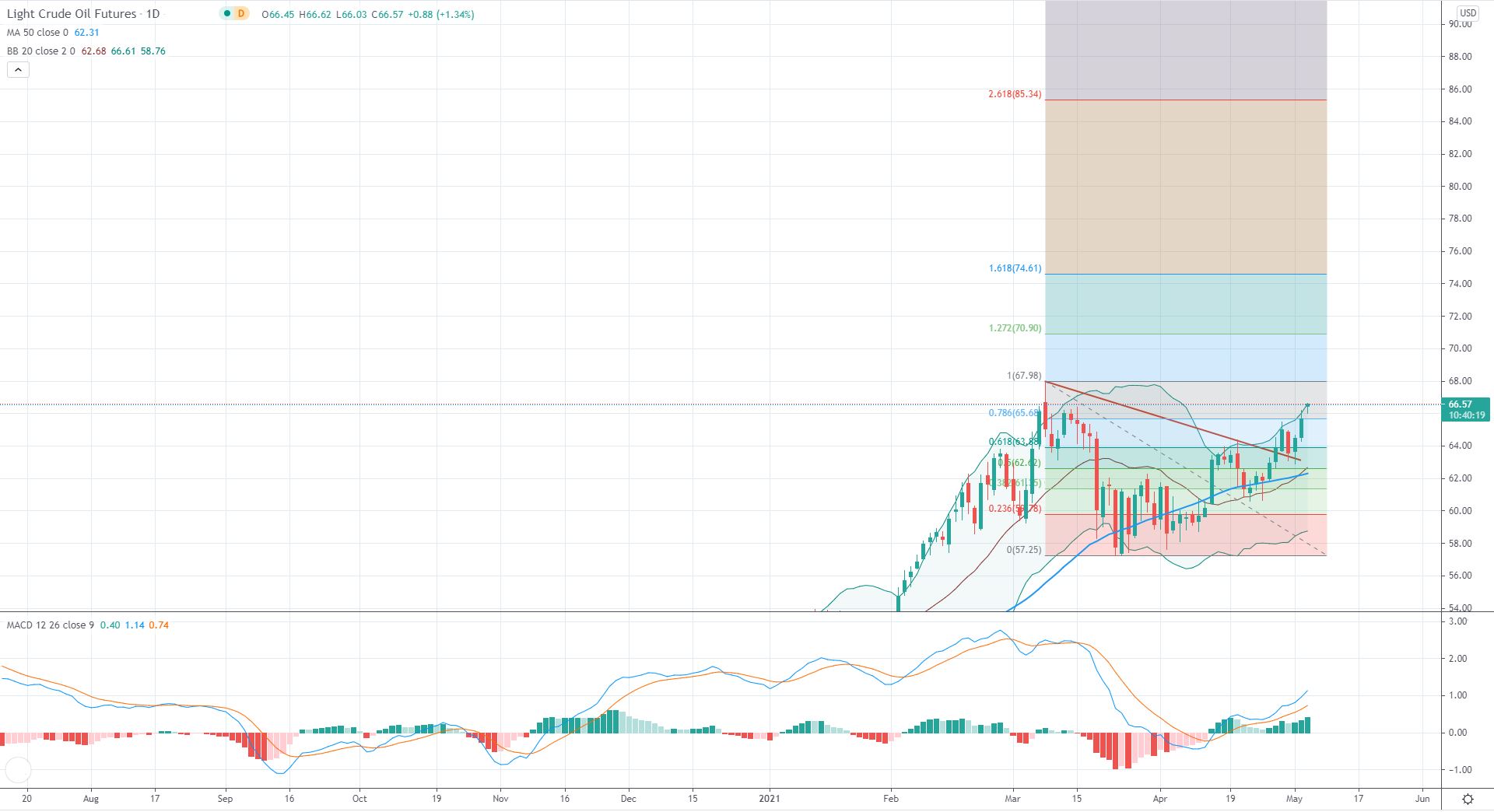

Important resistances include the March $67.98 high, and the 1.272 Fibonacci extension at $70.90. Important support levels sill include the 0.618 Fibonacci level at $63.90 and the 0.50 Fibonacci level which coincides with the 50 day Moving Average. The market is expecting the weekly inventories report to show a 1,900,000 barrel drawdown according to official forecasts, in which case a drop is usually impacting the price positively.

• The US markets will be full of activity for today as ADP Non-Farm employment Change opens the news sequence , followed by the important US Crude Oil Inventories. The large U.S. fiscal stimulus provided has shifted investors from worrying that growth will be too slow, to now fearing that growth will be too fast and put more upward pressure on interest rates. Despite that, last weeks’ interest rate decision by the Fed kept the rates unchanged and drove the dollar lower.

• At 12:15 GMT we have the ADP Non-Farm employment Change data. This report shows the estimated change in the number of employed people during the month of April, excluding the farming industry and government.

• At 14:00 GMT the ISM Services PMI report coming out. This report is based on surveyed purchasing managers, excluding the manufacturing industry and above 50.0 indicates industry expansion, below 50.0 indicates contraction.

• At 14:30 GMT Crude Oil inventory levels are expected to be announced which basically is the change in the number of barrels of crude oil held in inventory by commercial firms during the past week. If inventories drop it signals that there was increased demand for the period. Crude Oil Inventories also affect Canada as one of the biggest producers and consumers of fossil fuel.

US Indices yesterday :

• Dow Jones +0.06%

• S&P 500 -0.69%

• Nasdaq -1.88%