Market Drivers:

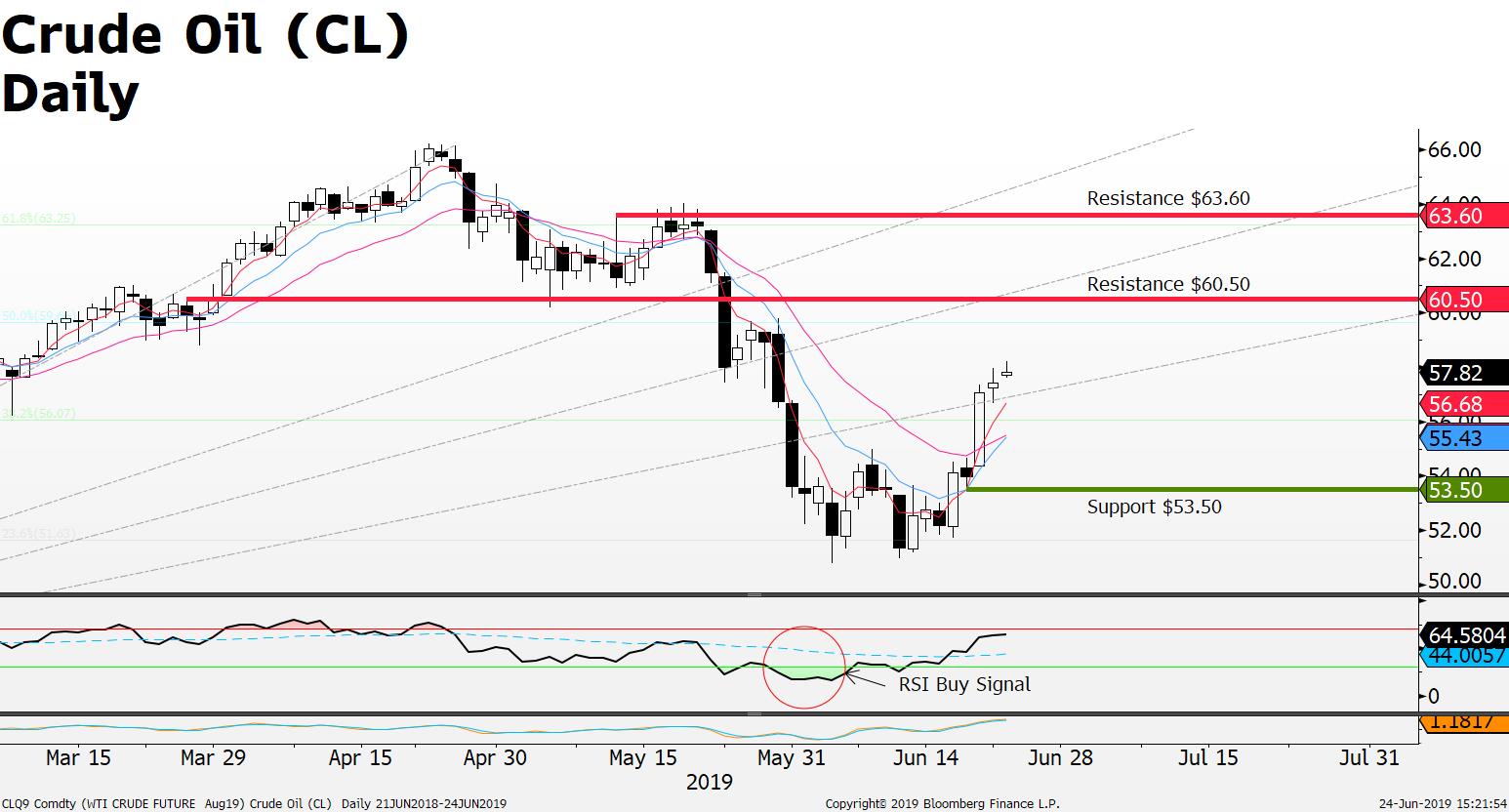

- Crude Oil (CL) +11% last 5 days; biggest weekly gain in two years; current price finds support after the U.S. will impose major new sanctions on Iran today, current price near $58; resistance at $60 support $55.85 ; upside momentum remains intact after Relative Strength Index (RSI) buy signal triggered technical move higher; long positions seen supported provided $53.50 support holds; upside seen near the 2018 High – Low 50% -61% retracement levels $60.50 and $63.60;

- Gold extended its climb above $1,400 +$64 last 5 days as investors buy precious metals on speculation that the US Dollar will weaken further ahead of any US interest rate cuts making gold prices more attractive for non-USD investors; current price $1,406; support $1,350 (previous break-out level) upside seen near $1,414.70 to $1,445 provided $1,411.60 can be overcome.

- US Dow Jones 30 Index trending higher on speculation that lower US interest rates our on the way; speculators supporting US stock prices on hopes that lower US interest rates will help boost US corporate profits and continue to drive the consumer on lower borrowing cost; current price 26,752 +622 points last 5 days; provided prices can hold above the 26,533 (resistance turned support) a further upside momentum move towards 27,178 to 28,227 can’t be ruled out;

- EUR/USD +160 pips last 5 days as the US dollar weakens on US interest rate cut forecast; Euro volatility set to increase this week as European largest economies publish key inflation data this week; EUR/USD current price; 1.1392; resistance 1.1450 support 1.1150 upside momentum remains intact;

Source: FXGM / Bloomberg